Fuel inflation hit Implats' Canada operation at the sky-high level of 71%.

Platinum group metals mining and marketing company Implats was unable to stem the high global inflation tide in the six months to December 31.

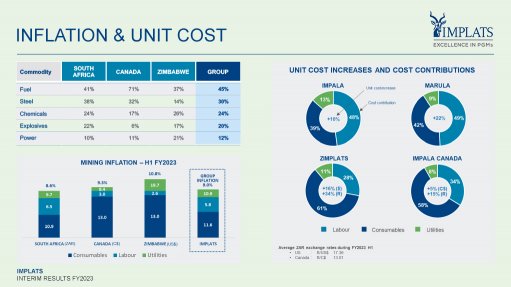

Half-year group unit costs per six element (6E) ounce rose 15% to R19 346/oz. Fuel inflation hit Implats’ Canada operation at the sky-high level of 71%.

“The one storm that we could not negotiate as well as I was hoping for was the high global inflation rates, so when you look at our unit cost increase, you will see a 15% increase in the unit costs up to R19 346/6E oz, the consequence of global inflation,” Implats CEO Nico Muller said during the company’s presentation of half-year financial and operational results, when gross profit was R17.2-billion and earnings before interest, taxes, depreciation and amortisation was R24.5-billion.

“It’s particularly consumables such as explosives, fuel, steel and power, but in addition to that we’re seeing the translation cost of our dollar in Zimbabwe and in Canada because of the weakening of the South African rand,” Muller said while displaying a slide that showed fuel up 45%, steel up 30%, chemicals up 24%, explosives up 20% and power up 10%.

“When you translate that back into rand, it adds to the cost increase and then we’ve seen reductions in efficiencies, mainly as a consequence of load curtailment” – the step that mining companies take during the loadshedding of electricity by Eskom.

“We have seen a similar increase in our capital expenditure, so the inflation has pulled into capital expenditure. If you just look at normal stay-in-business capital expenditure, you’ll see a similar increase in capital expenditure.

But in addition to that, our capital has ramped up in line with our investment strategy and the projects that have been approved,” Muller said.

Capital rose by 39% to R4.9-billion.

“A combination of increased capital, increased operating cost – in particular because of capital prepayments in Zimbabwe . . . people are not prepared to do work in Zimbabwe unless we pay them before they do the work, so increased capital is running ahead of the actual progress of work.

“Then, a very important issue for us during the last reporting period is the increase in inventory.

When we did have a hiccup is once the ore is reduced, it’s concentrated, but where we absorb load curtailment in Implats is at our smelter complex in Rustenburg.

“So when we are asked to reduce electricity consumption, we switch the furnaces off, or reduce the consumption, and so you will see that we were down 9% with the processing of refined 6E production.

“We normally operate with 625 000 oz roughly of inventory in the company at the end of the last reporting period. In the similar reporting period the previous year, we had 40 000 oz excess inventory and during this reporting period we increased that by another 100 000 oz.

“All of these things have had an impact. If you look at the earnings, they went up by 4%. Ebitda went up by 2% but when you translate that into cash flow, the cash flow reduced from R15.1-billion to R11-billion.

That also informed the dividend that was slightly better than the minimum 30% of our policy and retaining R5.9-billion on the balance sheet, which I think was done for very constructive purposes.

“Our R11-billion cash translated into a R4.20 per share dividend, which if you add the returns to minority shareholders of R600-million, it amounts to a total shareholder return of 36% of discretionary capital allocation,” Muller explained during the presentation, covered by Engineering News & Mining Weekly.