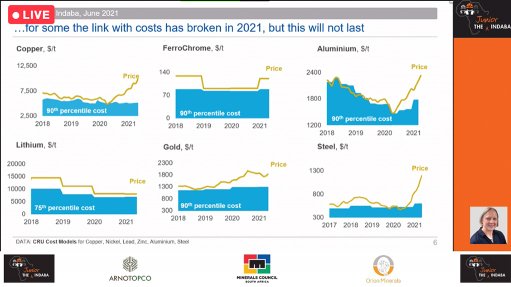

Commodity prices soaring above cost levels shown in this CRU chart.

Photo by: CRU

JOHANNESBURG (miningweekly.com) – Price hotness is pervading the commodities market, CRU senior analyst Clare Hanna said on Tuesday, when she addressed the second and final day of the Junior Indaba.

Speaking on ‘what’s hot and what’s not’, Hanna said almost all commodities were at the higher-than-15% level. (Also watch attached Creamer Media video.)

In fact, the CRU commodities price basket for 2021 over 2020 showed an average rise of 36.3%, with fertilisers the 73.8% high flyer and metals in general 37.3% up. (See attached charts.)

“Overall, prices are very high, some even rising to historical levels,” said Hanna, who flashed a chart onto the screen showing steel and iron-ore in the metals lead.

But when you have got prices rising at the rate that some of these commodities have done, it was unlikely that the high price rises of some of them could be sustained, partly because of the link with costs being broken, she said.

“In fact, we’re already entering a period of quite significant price volatility,” Hanna added in her presentation covered by Mining Weekly and chaired by Junior Indaba luminary Bernard Swanepoel.

“If you look at steel prices, the hot-rolled coil price has risen a further $50 in the last couple of weeks and is now close to $1 600/t, whereas the iron-ore price has come down from $220/t to $200/t,” she said.

Among the hottest in the 38-commodity CRU price basket are steel scrap, copper, aluminium, silico-manganese, ferrochrome, platinum, zinc, nickel and chrome ore.

Demand for copper, nickel, zinc, lithium, aluminium, hot-rolled steel, iron-ore and chrome is forecast to be good through to 2025.

HOT TOPICS

One of the hot topics is China’s latest five-year plan, which has endorsed a policy of internal and external dual circulation, and the other is carbon emissions.

China is rebalancing away from heavy infrastructure development and construction towards more consumption goods, moving from being the source of cheap goods towards high-value products and high technology goods, which involves less of a focus on steel and lower-grade commodities and a greater focus on goods in higher technology areas.

This also fits with stated government policy towards carbon reduction and the environment and gross domestic product driven by lower energy-intensive economic growth.

The Chinese government has restricted electricity availability to certain sectors to a greater extent than usual and has directed certain industries to produce less, with steel an example of that.

Hanna described carbon emission reduction as the number-one environmental, social and governance (ESG) topic of the moment.

ESG compliance, she said, was being driven by clients, which were asking increasingly about the greenness of products supplied, driven by carbon regulators looking at how carbon border taxes might work, project financiers and shareholders.

Displayed were graphics of aluminium smelters and steelworks being powered by renewables to a very limited extent and most receiving power from coal-fired and gas-related sources, which presents an ESG challenge. This same challenge was facing mining and metals companies.

“In Europe there’s a real push to decarbonise, and you can see a more supportive policy towards carbon dioxide reduction in the US following the election of President Joe Biden. Even in China, we’re beginning to see some fairly strong action. Anticipate that this will be a big issue and a big, hot topic for companies going forward,” said Hanna.

ELECTRIC VEHICLE GROWTH

The American jobs plan has commodity- and metals-intensive sectors. Some of those will be in infrastructure and construction projects, such as in rail, roads and bridges, airports, broadband, the power grid and electric vehicles. But the whole package is not signed off yet.

Hanna said that the growth in electric vehicle production would have significant impact on the mix of metals that might be required, with a sharper pick-up in electric vehicle growth forecast for beyond 2025.

“That’s what drives lithium from being a laggard to being off the chart,” she said.