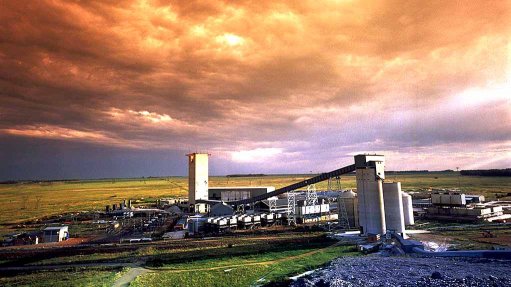

Harmony's Moab Khotsong mine

JSE-listed Harmony Gold's share price rose by more than 5% on February 22 after the company reported that its earnings per share (EPS) for the six months ended December 31, 2023, were likely to increase by more than 100% year-on-year to between R9.37 and R9.76 in rand terms and between $0.50 and $0.52 in dollar terms.

That compares with the EPS of R2.98, or $0.17, reported for the six months ended December 31, 2022.

Headline earnings a share are likely to be in the same ranges as the EPS.

Harmony attributed the increase in EPS to higher recovered grades at its South African operations, an increase in gold production and a higher average gold price received, as well as to an increase in the production of silver at the Hidden Valley operation, in Papua New Guinea, and higher uranium production at Moab Khotsong, in South Africa.

The increase in earnings was partially offset by an increase in production costs owing to inflationary increases in labour and electricity costs as planned, and higher royalty taxes driven by an increase in revenue and profitability; an increase in amortisation and depreciation as a result of higher depreciation recognised for Hidden Valley's stripping activities; additional exploration expenditure incurred for the execution of an updated feasibility study of the Eva copper project, in Australia; and an increase in the current taxation owing to higher taxable income resulting from favourable gold prices and an increase in gold sold.

Harmony will publish its interim results on February 28.