167 MW of solar power in place by financial year 2025.

JOHANNESBURG (miningweekly.com) – South Africa’s largest gold producer by volume, Harmony Gold, has begun an “aggressive” renewable energy rollout plan as it advances its plans to decarbonise to net zero by 2045, Harmony CEO Peter Steenkamp said on Monday.

The rollout plan involves having 167 MW of solar power in place by financial year 2025 (FY25). (Also watch attached Creamer Media video.)

“As the global focus on decarbonisation increases, we understand that we too have an important role to play to reduce our Scope 2 emissions and reduce our carbon footprint,” said Steenkamp during the Johannesburg- and New York-listed company's presentation of financial results.

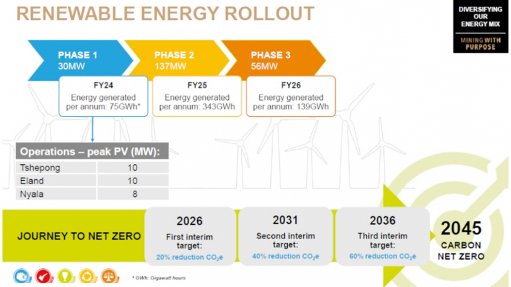

Harmony has made a strategic decision to accelerate the rollout of its renewable energy over three phases.

Commercial close is imminent for the first phase 30 MW power purchase agreement in the Free State. This will generate 75 GWh of clean power a year and is expected to be completed in FY24.

The second phase of the 137 MW, which will be completed by the end of FY25, will be funded internally by Harmony itself.

This project is expected to cost about R1.5-billion and will deliver R500-million worth of cost savings along with 340 GWh of energy a year.

The third 56 MW phase is being planned for completion in FY26.

These projects contribute towards the aspiration of Harmony Gold being carbon net zero by 2045.

“They derisk our business while delivering significant economic value to Harmony and improving the well-being of our host communities or many years to come,” Steenkamp said during the presentation covered by Mining Weekly.

Many of the renewable energy plants will be aligned to long-life assets.

Harmony’s re-engineered South African operations have been grouped across a seven-to-20-year life-of-mine spectrum and much of the company’s major capital has been allocated to its long-life assets to ensure that they deliver high grades and better volumes.

Mines such as Moab Khotsong, Mponeng, Doornkop and its surface operations will receive most of the company’s project capital.

“We are investing in these assets to prolong their economic life,” said Steenkamp.

The Moab Khotsong operations will expand through Zaaiplaats and the Great Noligwa shaft pillar will also be mined.

Studies are being conducted into the potential deepening of Mponeng and also the mining of the Tau Tona and Savuka shaft pillars.