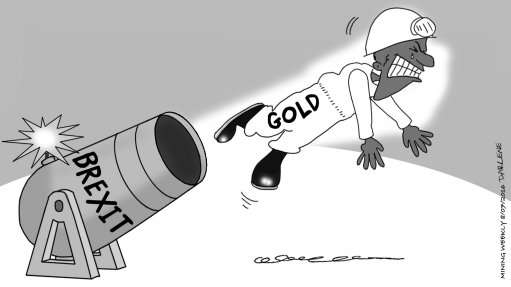

Gold, which has risen 25% this year, is holding onto its Brexit gains, as investors make use of its safe-haven status to keep it above the $1 300/oz mark. Schroders fund managers Mark Lacey and James Luke emphasise that gold equities in particular are offering a compelling investment case. They believe gold equities are likely to outperform the gold price in coming years. According to ratings agency Moody’s, Brexit stands to generate an additional $120-million in free cash flow for gold mining company AngloGold Ashanti and an additional $50-million for Gold Fields in the first half of 2016. The World Gold Council foresees a “staggering” level of protracted uncertainty providing solid support for gold, while depreciating local currencies provide the benefit of lower operating costs in dollars.