Photo by: Atlantic Minerals

Name of the Project

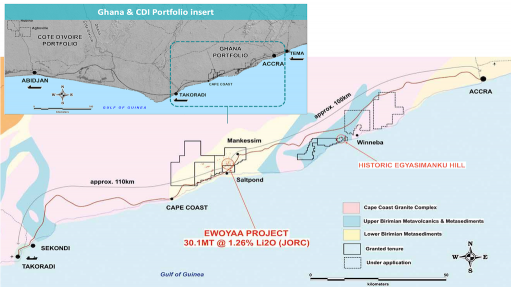

Ewoyaa lithium project.

Location

Ghana.

Project Owner/s

Aim-listed lithium explorer and developer Atlantic Minerals. Piedmont has an earn-in right of 50% of Atlantic’s Ghanaian projects, including Ewoyaa, and the company holds a 10% equity interest in lithium explorer Atlantic Lithium.

Project Description

Ewoyaa has probable reserves of 25.6-million tonnes grading 1.22% lithium oxide. Total mineral resources are estimated at 35.3-million tonnes grading 1.25% lithium oxide.

Over the 12-year life-of-mine (LoM), the project is expected to produce 3.58-million tonnes a year of 6% and 5.5% spodumene concentrate, as well as 4.7-million tonnes of secondary product as a by-product of dense-media separation (DMS).

Development involves the opencut mining of several lithium-bearing pegmatite deposits, conventional DMS processing and supporting infrastructure.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $1.5-billion and an internal rate of return of 105%, with a payback of 19 months.

Capital Expenditure

$185-million.

Planned Start/End Date

Production of spodumene concentrate and secondary product are targeted for the second quarter of 2025.

Latest Developments

The Ghana Ministry of Lands and Natural Resources has granted a mining lease for the project. Receipt of the mining lease marks a significant step towards production.

The mining lease provides exclusive rights to conduct lithium mining and commercial production activities for an initial 15-year period. The issuance of the mining lease is subject to ratification by the Ghanaian Parliament. This follows the announcement in September 2023 by the Minerals Income Investment Fund (MIIF) of Ghana of its plans to invest $27.9-million to acquire a 6% stake in Ewoyaa, and an additional $5-million to be invested in Atlantic to partially assist in developing Ewoyaa.

The approval of the Environmental Protection Agency of Ghana will also be required before construction can start and Atlantic expects the permitting process to be finalised in the second half of 2024.

Piedmont owns a 9% equity interest in Atlantic and, in August, announced that it exercised its option to acquire an initial 22.5% interest in Ewoyaa, subject to government approvals. Piedmont has a right to earn an additional 27.5%

interest in the project, subject to satisfying certain funding criteria, which would result in Piedmont and Atlantic each owning 50% of Ewoyaa, exclusive of the expected MIIF investment and the Ghanaian government’s carried interest.

Piedmont also holds an offtake agreement to buy 50% of lithium concentrate production at Ewoyaa on a market-based pricing mechanism for the LoM.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Atlantic Minerals, tel +61 2 8072 0640 or email info@atlanticlithium.com.au.