Photo by: Atlantic Minerals

Name of the Project

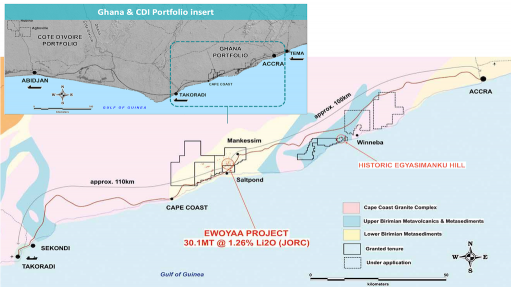

Ewoyaa lithium project.

Location

Ghana.

Project Owner/s

Aim-listed lithium explorer and developer Atlantic Minerals. Piedmont has an earn-in right of 50% of Atlantic’s Ghanaian projects, including Ewoyaa, and the company holds a 10% equity interest in lithium explorer Atlantic Lithium.

Project Description

Ewoyaa has probable reserves of 25.6-million tonnes grading at 1.22% lithium oxide. Total mineral resources are estimated at 35.3-million tonnes grading at 1.25% lithium oxide.

Over the 12-year life-of-mine, the project is expected to produce 3.58-million tonnes a year of 6% and 5.5% spodumene concentrate, as well as 4.7-million tonnes of secondary product as a by-product of dense-media separation (DMS).

Development involves the opencut mining of several lithium-bearing pegmatite deposits, conventional DMS processing and supporting infrastructure.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $1.5-billion and an internal rate of return of 105%, with a payback of 19 months.

Capital Expenditure

$185-million.

Planned Start/End Date

Production of spodumene concentrate and secondary product are targeted for the second quarter of 2025.

Latest Developments

Piedmont Lithium has thrown its support behind Aim- and ASX-listed Atlantic Lithium’s development of Ewoyaa.

Atlantic reported in late August that Piedmont had notified the company of its intent to support the development of Ewoyaa towards production.

As part of a staged investment agreement to earn a 50% interest in Atlanic’s spodumene projects, in Ghana, Piedmont has exercised its option to acquire an initial 22.5% interest to fast-track the development of the project.

To earn the full 50% interest in Atlantic’s Ghana portfolio, Piedmont will sole-fund the first $70-million, and 50% of any additional development expenditure, towards the total $185-million development expenditure for the project indicated in the definitive feasibility study.

Atlantic has said that this stage of funding will result in the construction and initial production of spodumene concentrate at the project, with production for 2025, after required licences and approvals have been received.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Atlantic Minerals, tel +61 2 8072 0640 or email info@atlanticlithium.com.au.