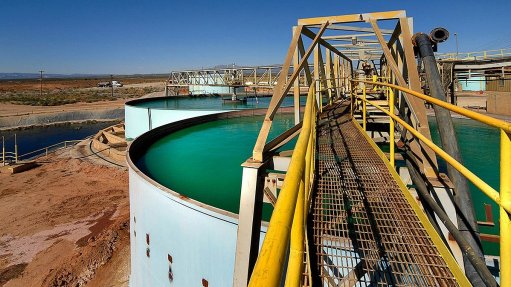

The White Mesa uranium mill

US-based Energy Fuels has executed three long-term contracts with major US nuclear utilities, committing to deliver up to 4.2-million pounds between 2023 and 2030, as utilities are increasingly seeking contracts with non-Russian producers.

The company will fulfil deliveries during the early years of these contracts from its existing inventories, but CEO Mark Chalmers said on Friday that it planned to restart production at one or more if its mines and in-situ recovery facilities, starting as soon as 2023.

“Our substantial inventories will also allow Energy Fuels the potential to offer significant quantities of uranium to the new US uranium reserve,” he stated.

The Department of Energy issued a request for proposals to purchase uranium for the new reserve in June, with up to one-million pounds of U3O8 to be bought from up to four qualified US uranium producers. The uranium must be physically located at Honeywell’s Metropolis Works conversion facility.

Energy Fuels believes it meets all the qualifications to supply the reserve. The company currently holds about 692 000 pounds of U3O8 at the US converter.

Chalmers said that, during the second half of 2022, Energy Fuels expected to shift back to processing stockpiled ores for uranium production, and that it would produce 100 000 lb to 120 000 lb of uranium in 2022.

Meanwhile, he stated that Energy Fuel’s rare earth initiative continued to proceed well. “We believe we are making more progress, faster, than any other US company. Last year, we began production of a high-purity mixed rare earth carbonate that is ready for separation. No other company in the US is commercially producing a product as advanced as Energy Fuels.”

In the first half of 2022, the company produced about 205 t of mixed rare earth element carbonate, containing 95 t of total rare-earth oxides.

Energy Fuels also sold about 575 000 lb of its existing inventory of vanadium for an average of $13.44/lb of V2o5 in the first six months of the year. However, with vanadium markets having dropped in recent weeks, the company has halted sales of its inventory, which currently stands at about 1.05-million pounds.

Energy Fuels is evaluating the potential to resume vanadium recovery at its White Mesa mill in the future as market conditions may warrant future sale and to replace sold inventory. It is estimated that its tailing pond solutions contain an estimated additional one-million to three-million pounds of V2O5.