Vancouver-based Great Panther Mining on Monday announced a positive production decision for its Coricancha gold/silver/lead/zinc/copper mine, in Peru, but said that an actual restart date would only be determined next year.

The positive production decision followed the final results of the trial stope and bulk sample programme, which confirmed the key operating assumptions for Coricancha contained in the 2018 preliminary economic assessment (PEA) of the project.

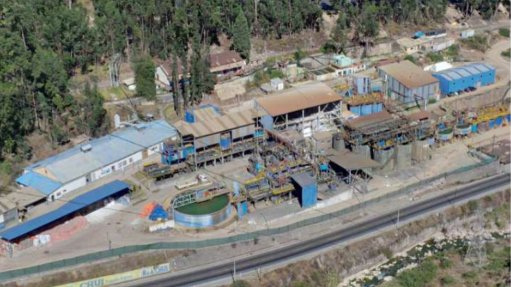

The company has not completed a feasibility study, but explained that it decided to move ahead to production as the project had an existing processing plant facility, required a low initial capital outlay and because of its knowledge of the mine and resource base.

Coricancha would be kept on care and maintenance to allow for additional engineering and operational planning prior to start up.

"The actual restart date is expected in the first half of 2020 and will be aligned with our other mining operations to ensure the project has the necessary planning and resources in place to optimise operations and profitability,” said president and CEO James Bannantine.

The development timeline necessary to restart Coricancha and reach full scale production is expected to be less than one year.

Coricancha is expected to produce about 40 000 gold-equivalent ounces a year and will be an important addition to Great Panther's production portfolio going forward.

The May 2018 Coricancha PEA estimated an after-tax internal rate of return of 81% and an after-tax net present value, at a 7.5% discount rate, of $16.6-million.

According to the PEA, total capital cost of $32.4-million is required for the mine and processing plant, of which $8.8-million will be initial costs and $23.6-million sustaining capital costs.

Great Panther said previously that it would be able to fund the restart of Coricancha entirely from its current cash reserves.