Precious metals miner Great Panther Mining on Tuesday filed for creditor protection, as the company warned that it would likely default on several material debtor agreements owing to liquidity constraints.

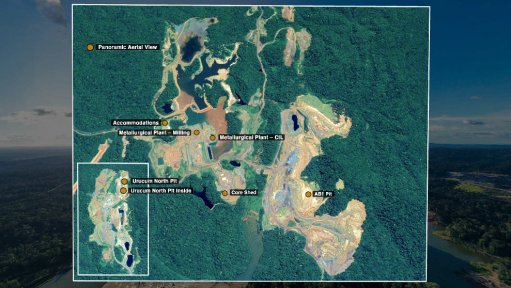

The TSX-listed miner also announced that it would place its Tucano gold and silver mine, in Brazil, on care and maintenance.

Great Panther stated that its liquidity constraints stemmed from operational challenges, inflationary pressures that significantly impact on costs, unforeseen but necessary capital expenditures, and contractor mobilisation delays owing of equipment availability issues.

Following consultation with its legal and financial advisers, the board of directors determined that it was in the best interests of the company and its stakeholders to file a notice of intent (NOI) and obtain creditor protection.

Management would seek the conversion of the Bankruptcy and Insolvency Act proceedings into proceedings under the Companies' Creditors Arrangement Act (CCAA) should management determine that CCAA proceedings would be more appropriate.

The effect of the NOI is an immediate stay of proceedings for 30 days, which may be extended by subsequent court order. Filing the NOI will allow the company to pursue available options.

Alvarez & Marsal Canada has been appointed as proposal trustee pursuant to monitor the company's operations and restructuring.

Great Panther's stock fell by 55% to $0.81 apiece on the NYSE American.