Given the absence of inflation indexation, Capital Gains Tax (CGT) in South Africa (SA) is currently costlier than the published rate; the calculations below illustrate CGT becoming an all-encompassing problem if inflation rises further. Business owners and Boards of companies that are developing operations in sub-Saharan Africa should ponder and consider restructuring their non-SA operations in order to reduce the long-term CGT liabilities that are accumulating in their balance sheets.

SA corporate taxpayers are currently subjected to CGT at a rate of 22.4% on disposal of assets. Notwithstanding the fact that SA has an inflation rate fluctuating at around 6% pa versus the average inflation rate of the G20 economies which fluctuate at around 2%, the SA taxpayer is not entitled to any inflation indexation relief when calculating their CGT liabilities on realisation of assets.

When CGT was introduced in 2001, the National Treasury said indexation was not appropriate in the light of the low inclusion rate of 25% of the total gain. However, the inclusion rates keep on being increased and is currently levied at 80% for companies and trusts, and 40% for individuals.

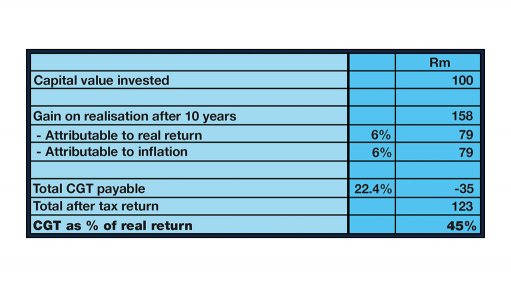

Globally long-term average real returns on assets such as equity and property have generated around 4-6% pa. Assuming a SA corporate taxpayer invests R100 million for 10 years before disposing of the asset for an amount generating a real return of 6% plus 6% inflation, CGT will be equivalent to 45% of the real (after inflation) gain made.

Recent statements by leading politicians and government officials regarding the need to review the SA Reserve Bank’s inflation target policy indicate that a looser monetary policy may be in the offing, which if it materialises, will predictably be followed by a rise in inflation. Such an event will be disastrous for business owners if it persists for an extended period of time. If inflation rises to (say) 12% pa, 100% of the real gain will simply be taxed away by CGT. In effect, most growth in capital will be nationalised through CGT in the absence of inflation indexation.

The CGT rate for corporates was recently increased from 18.6% to 22.4%. The government is actively searching for ways to raise additional tax revenue in order to reduce the budget deficit, which is being exacerbated by the lack of economic growth resulting from the current recession. Given the levels of disparities in income in SA, a further raising of CGT rates is one of the more obvious and politically expedient ways of obtaining additional tax.

Should the CGT rate for companies be increased further, after inflation has increased to (say) 12%, the real effective CGT rate increases exponentially to well above 100%. Thus, the effect of a combination of slightly higher CGT rates combined with higher inflation will quickly result in a negative growth – resulting in taxpayers generating real losses after CGT on most their investments.

The value of business operations held in foreign subsidiaries of SA holding companies add to the value of the holding company, and

attract SA CGT on disposal of either the foreign operations, or through its additive value on disposal of the holding company shares.

Business owners should actively be weighing up the long-term consequences of the rise in inflation and CGT. They should consider the various options available to them and make calculated decisions on structuring their non-SA operations in such a way as to limit the potentially disastrous effect of a rise in inflation or CGT rates. Possibilities do exist to structure non-SA operations more tax efficiently provided care is taken to plan the offshore holding company structure properly.

This includes;

- Transferring assets at arms-length valuations, preferably using independent valuators;

- Complying with Exchange Control Regulations;

- Considering Base Erosion and Profit Sharing and Common Reporting Standard regulations across operational jurisdictions;

- Ensuring the foreign operations are properly domiciled and that a place of effective management and control is established;

- Selecting a cost-effective jurisdiction such as Mauritius which has no CGT and is seen as a major gateway to Africa, with a good network of double taxation and investment protection and promotion treaties;

- Selecting experienced advisors to plan and assist in implementation of the structure.

Contact Adansonia