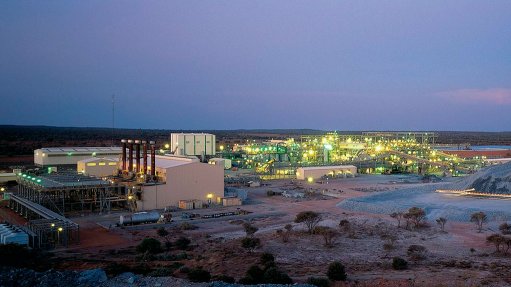

The Nickel West operation

Diversified mining company BHP is “evaluating options” at its Nickel West mine, in Australia, to mitigate the impacts of the sharp fall in nickel prices, CEO Mike Henry said on Thursday.

Nickel West produced 39 800 t of nickel in the first half of the 2024 financial year, with higher output attributed to a shorter shutdown period at the Kalgoorlie smelter, offsetting downtime at the Kwinana refinery.

Cobalt byproduct output from Nickel West increased by 13% year-on-year to 374 000 t.

While the miner kept its production guidance unchanged at between 77 000 t and 87 000 t for the full year, the company cautioned that Nickel West was not immune to the challenges that the nickel industry was facing.

“The nickel industry is undergoing a number of structural challenges and is at a cyclical low in realising pricing,” BHP stated.

The miner’s average realised nickel price plunged by 24% in the first half of the 2024 financial year, compared with the same period in the previous year, to $18 602/t of metal. The second quarter’s price was even lower at $16 812/t.

Given the market conditions, the group is doing a carrying value assessment of its nickel assets and will provide an update with the release of its financial results next month.

Australian nickel producers are under pressure. Several producers have cut back production and reported writedowns in recent months.

Earlier this week, First Quantum Minerals announced that it would scale back operations and cut jobs at the Ravensthorpe mine, noting that it expects the downturn in prices to last three years.

Panoramic Resources’ administrators are shutting down the Savannah project, while IGO has flagged impairments at its Cosmos nickel project.