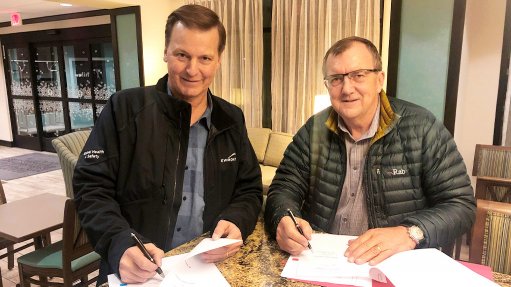

Newmont Mining CEO Gary Goldberg (left) and Barrick Gold CEO Mark Bristow (right)

Canadian gold major Barrick Gold has ended its hostile takeover offer for US miner Newmont Mining and instead agreed to create a joint venture (JV) combining their respective mining operations, assets and reserves in Nevada.

The two gold miners have been operating independently in Nevada for decades, but have previously been unable to agree on terms for cooperation.

In a joint statement, Barrick and Newmont said that the JV would allow them to capture an estimated $500-million in average annual pre-tax synergies in the first full five years of the combination, which is projected to total $5-billion pre-tax net present value over a 20-year period.

The creation of a JV ends a bitter hostile takeover battle between the world’s largest gold miners, which has seen CEOs trading insults. Barrick last month launched an $18-billion takeover offer for Newmont, which the US major rejected. Newmont’s board argued that it would be better off completing the purchase of Canadian miner Goldcorp.

Last week, Barrick’s top shareholder said that the miner should focus on striking a JV in Nevada, before considering a full-blown merger.

Barrick president and CEO Mark Bristow said on Monday that the JV agreement with Newmont marked the successful culmination of a deal that had been more than 20 years in the making.

“We listened to our shareholders and agreed with them that this was the best way to realise the enormous potential of the Nevada goldfields’ unequalled mineral endowment, and to maximise the returns from our operations there,” he commented.

Newmont CEO Gary Goldberg said that the logic of combing the two companies’ operations “was compelling”.

“This agreement represents an innovative and effective way to generate long-term value from our joint assets in Nevada, and represents an important step forward in expanding value creation for our shareholders. Through the JV, we will also continue to pursue the highest standards in safety, along with responsible and meaningful engagement with our employees, communities and other stakeholders,” he said.

Following the completion of the JV, the Nevada complex would be the world’s single-largest gold producer, with a pro-forma output of more than four-million ounces in 2018, three tier-one assets, potentially another one in the making, and 48-million ounces of reserves.

The JV would exclude Barrick’s Fourmile project and Newmont’s Fiberline and Mike deposits, pending the determination of their commercial feasibility.

In a separate statement on Monday, Goldcorp said that it had consented to, and fully supported, the Nevada JV between Barrick and Newmont.

Newmont is buying Goldcorp in a $10-billion stock-for-stock transaction, which has already gained Canadian Competition Bureau approval.