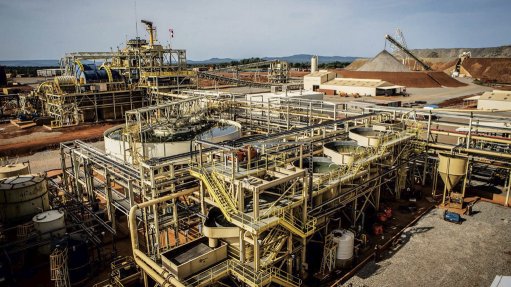

The Fekola mine, in Mali.

Canadian bullion miner B2Gold has hiked its 2021 guidance to between 1.012-million and 1.055-million ounces, following a strong third quarter in which output came in above target.

The company produced 310 261 oz, including 14 538 oz of attributable production from its interest in Calibre Mining.

Consolidated production from B2Gold’s three operating mines was 20 083 oz above its budget, producing 295 723 oz. Fekola, in Mali, and Otjikoto, in Namibia, each delivered a record performance of 165 557 oz and 68 959 oz, respectively. Masbate, in the Philippines, produced 61 207 oz and its performance was also above guidance.

B2Gold increased the guidance of the Fekola and Masbate mines, resulting in its consolidated guidance for its three operating mines increasing to between 965 000 oz and 995 000 oz, from between 920 000 oz and 970 000 oz.

For the third quarter, B2Gold reported consolidated gold revenue of $511-million on sales of 286 650 oz at an average realised price of $1 782/oz, compared with $487-million on sales of 253 200 oz at an average price of $1 924/oz in the same quarter last year.

Meanwhile, B2Gold has exercised its option to acquire an additional 19% interest in the Finland joint venture (JV) with Aurion Resources, taking its total interest to 70%.

The JV covers an area of about 331 km2 along the major crustal scale Sirkka Shear Zone in the Central Lapland Greenstone Belt, and includes a number of discoveries such as Kutuvuoma (16.47 g/t gold over 11.0 m), Soretiavuoma (48 g/t gold over 1.1 m), Sinermä (0.54 g/t gold over 40.2 m), Kiekerömaa (5.8 g/t gold over 5.0 m) and Kettukuusikko (4.33 g/t gold over 20.4 m).

Since the inception of the agreement, B2Gold has completed more than C$15-million in exploration expenditures, paid Aurion C$50 000 in cash and issued 550 000 B2Gold shares.

B2Gold would sole fund all programmes and budgets until completion of a feasibility study as required under the remaining option to acquire an additional 5% ownership interest, subject to its right to terminate sole funding at any time.

B2Gold is currently completing a 5 000-m diamond drill programme on the Kutuvuoma-Ikkari corridor, as well as base of till and trenching programmes on a number of targets in the eastern part of the JV property.