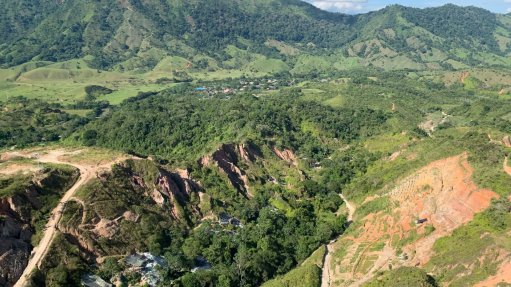

Joint venture (JV) partners B2Gold and AngloGold Ashanti are reviewing alternatives for their Gramalote project, in Colombia, after the preliminary optimised feasibility study for the project failed to impress.

Both parties agreed that the project does not meet their investment thresholds to proceed with further development, says B2Gold CEO Clive Johnson, noting that the project may be sold.

The JV is in the process of doing an updated feasibility study – due for completion in the third quarter – with a view of improving the economics. The previous study estimated a 15% internal rate of return (IRR), using $1 500/oz gold.

One way was to look at different engineering and design approaches to reduce capital costs. Through this work, the company has knocked off about $100-million from the original projected capital cost of more than $900-million. However, most of these gains from the reduction of capital were wiped out by the effect of inflation, Johnson reports.

On a global scale, cost inflation has resulted in estimated capital cost increases of about 12%, coupled with uncertain long-term costs.

The second way to improve economics was to expand the resource through additional infill drilling, thereby dividing the capital costs by more ounces. “Unfortunately, drilling is hard to predict. We didn’t get [the] additional ounces we hoped for,” Johnson says.

More detailed resource modelling indicates that the grade-tonnage characteristics of the orebody resulted in lower-than-expected processing head grade and yearly ounce production, specifically within the first five years of production including the payback period. These changes result in lower-than-expected project net present value and IRR, below the investment threshold of each JV partner.

The good news about Gramalote is that projected operating and all-in sustaining costs (AISC) remained “quite low”, Johnson notes. The project benefits from a low strip ratio, low processing costs, and a favourable relationship with the local and regional stakeholders.

Going forward, B2Gold and AngloGold will evaluate alternatives, including a smaller project approach or selling the asset.

However, given that B2Gold will not proceed with Gramalote, it has a strong cash position that places it in good stead to explore merger and acquisition opportunities.

“We are looking at a few things right now,” Johnson told analysts on a conference call. “We are in an extremely strong cash position with no debt and are able to continue to pay one of the leading dividends on a yield basis in our sector. We also have a significant amount of money to devote to exploration and potentially the next development projects . . . but also, if we find something we like, we can use our strong cash position when we look at M&A without the need to significantly dilute our shareholders.”

SECOND-QUARTER RESULTS

B2Gold, which operates mines in Mali, Namibia, and the Philippines, said this week it was pleased with its second-quarter results, given the challenges mining companies are facing around the world.

The miner produced a total of 223 623 oz, including 14 765 oz of attributable production from Calibre Mining, slightly above budget by 1% and consolidated gold production of 208 858 oz from the company's three operating mines, in line with budget.

It reported gold revenue of $382-million on sales of 205 300 oz at an average realised gold price of $1 861/oz.

Based on a strong operational and financial first half of 2022, the company is on track to meet its gold production guidance for 2022 of between 990 000 oz and 1.05-million ounces. Consolidated cash operating costs and AISC were below budget for the first half of 2022.

Total consolidated costs guidance ranges for full-year 2022 remain unchanged. Cash operating costs for the full year are expected to be at the upper end of the company's original guidance range of between $620/oz and $660/oz and within its total consolidated AISC guidance range of between $1 010/oz and $1 050/oz.