Name of the Project

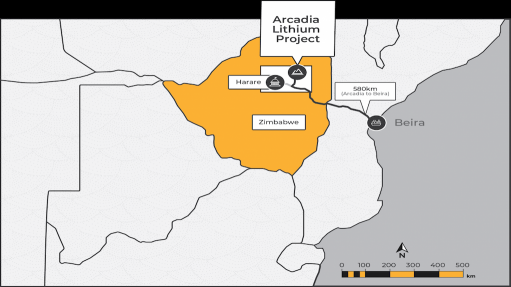

Arcadia lithium project.

Location

Zimbabwe.

Project Owner/s

Zhejiang Huayou Cobalt acquired Arcadia from Australia-listed Prospect Resources PSC.AX and its Zimbabwean partners in a $422-million deal completed in 2022.

Project Description

A direct optimised feasibility study (OFS) has shown the strong potential of Arcadia to become a compelling long-life, large-scale, hard-rock openpit lithium mine.

The direct OFS envisages a development pathway that entails the construction of a 2.4-million-tonne-a-year nameplate capacity plant in a single stage, unlike the staged OFS that considered the construction of two 1.2-million-tonne-a-year modules.

Average production in concentrate has increased from 133 000 t/y of spodumene in the staged OFS to 147 000 t/y in the direct OFS, technical petalite from 86 000 t/y to 94 000 t/y and chemical petalite from 22 000 t/y to 24 000 t/y.

The Arcadia deposit will be mined as a conventional truck-and-shovel openpit operation using contract mining. Waste dumps are to be located as close as possible to pit exit points to minimise haulage profiles without disrupting the access to the mineable resource or crushing plant.

The mine life has decreased from 20 years in the staged OFS to 18.3 years in the direct OFS.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project had a pretax net present value (NPV), at a 10% discount rate, of $465-million in the staged OFS and an internal rate of return (IRR) of 35%, with a payback of 5.4 years from the final investment decision.

In the direct OFS the project has an NPV, at a 10% discount rate, of $1.02-billion and an IRR of 61%, with a payback of 3.33 years from the final investment decision.

Capital Expenditure

The direct OFS estimates preproduction capital expenditure at $192.46-million.

The staged OFS required a total capital investment of $212-million – $140-million for Stage 1 and $72-million for Stage 2.

Planned Start/End Date

Not stated.

Latest Developments

All production lines at the Arcadia lithium mine project have completed equipment installation and commissioning, and trial production has started, successfully producing the first batch of products.

Key Contracts, Suppliers and Consultants

Lycopodium (direct DFS).

Contact Details for Project Information

Zhejiang Huayou Cobalt, tel +86 573 88589981.

Prospect Resources, tel +61 405 524 960 or email info@prospectresources.com.au.