ARM's growth outlook.

JOHANNESBURG (miningweekly.com) – Diversified mining company African Rainbow Minerals (ARM) has invested R1-billion of capital to deliver early ounces at the Bokoni platinum group metals (PGMs) mine, the company said on Monday when the JSE-listed company delivered 40%-higher headline earnings to R5 171-million in the six months to the end of December.

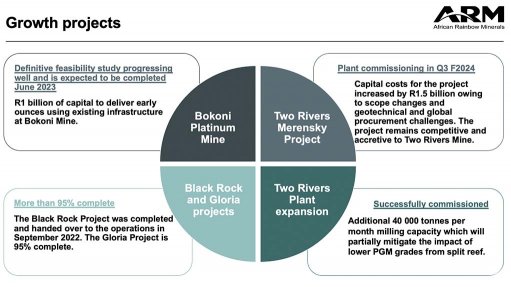

The definitive feasibility study for newly acquired Bokoni is expected to be completed by June by the company headed by Dr Patrice Motsepe, which declared an interim dividend of R14 a share amounting to R3 145-million.

On growth projects, ARM reported that the capital cost of the plant commissioning of the Two Rivers Merensky project had increased by R1.5-billion owing to scope changes as well as geotechnical and global procurement challenges.

This project remains competitive and accretive to the Two Rivers mine, ARM stated in its presentation in which the commissioning of an additional 40 000 t a month capacity at the Two Rivers plant expansion was described as being successful. The development of the Bokoni mine and the Two Rivers Merensky project provides more than 100% growth in ARM’s PGM six element (6E) ounce profile over the next five years as ARM invests in brownfield projects to unlock value from the large resources in its portfolio that include the Modikwa PGMs operation, Mining Weekly can report.

PGMs, at 44%, were the biggest contributor to ARM’s earnings before interest, taxes, depreciation and amortisation (Ebitda) in the last six months of last year, followed by iron-ore at 32%.

ARM is projecting an 118% increase in PGMs production in the next five years to 2027, when the group output will have more than doubled from 299 000 oz a year in its 2023 financial year to 652 000 oz in its 2027 financial year, based on approved projects and unapproved projects under consideration.

The Ebitda of the PGMs business is a high 51%, with iron-ore at 46%. Rhodium at 45% and palladium at 28% were the two biggest contributors to revenue, followed by platinum at 19%. Lower PGM prices in dollars were largely offset by the weaker rand.

The ARM Ferrous business reported 15% lower iron-ore sales volumes to 5 652 t owing to logistical challenges. Engagement with rail authority Transnet to address these challenges is under way.

Manganese ore sales were 6% up, however, at 1 779 t mainly owing to the sale of ultra-fines product. Included in the export sales volumes is 90 000 t of manganese that was transported by road to Saldanha Bay. The Black Rock and Gloria manganese projects were handed over to operations last year.