Receive our free daily newsletter:

NYSE American-listed Uranium Energy Corp (UEC) has filed an initial economic evaluation for the Alto Paraná titanium project, in Paraguay, upgrading the resource, refining the technical approach to...

Australia-listed Macro Metals on Tuesday announced a binding option to acquire 85% of the lithium rights of the Aurora project in Oregon, US, from fellow-listed Aura Energy Metals. Nonexecutive...

Namibia- and Canada-focused uranium mining and exploration company Madison Metals has successfully renewed exclusive prospecting licence (EPL) 7011 in the Madison North project area, adjacent to...

Higher free cash flow, higher recovered grades, higher production and higher received gold price have been reported by Harmony Gold in its operational update for the three months ended September...

Proxy advisory firm Institutional Shareholder Services (ISS) has recommended Consolidated Uranium (CUR) shareholders vote for the resolution to approve the previously announced merger with...

Canada-based Cameco announced this week that the acquisition of Westinghouse Electric Company (Westinghouse) in a strategic partnership with Brookfield Asset Management, alongside its publicly...

Dual-listed NexGen Energy on Thursday announced Ministerial approval from Saskatchewan to proceed with the development of its Rook I uranium project. NexGen is the first company in more than two...

Uranium exploration and development company Laramide has received firm commitments to raise A$12-million to accelerate its development projects in the US and to ramp up drilling at its exploration...

The uranium rights over a large portion of tenure in the Pine Creek region of Northern Territory (NT) have returned to PNX Metals, after the expiry of a ten-year farm-in agreement with private...

Australia-listed junior Elevate Uranium on Wednesday announced a 136% increase in the mineral resource estimate of its Koppies project, which now stands at 48-million pounds of uranium oxide...

Assay results from the 2023 summer exploration programme at the Gemini uranium discovery, in Canada’s Athabasca basin, have confirmed a new parallel mineralised zone, ASX-listed explorer 92 Energy...

NYSE America- and TSX-V-listed enCore Energy is gearing up to resume uranium production at the Rosita central processing plant (CPP) before month-end, the company confirmed on Monday. This comes...

Uranium exploration company Denison Mines has completed its inaugural in-situ recovery (ISR) field test programme within The Heldeth Tue (THT) uranium deposit at its 67.41%-owned Waterbury Lake...

US-based critical minerals company Energy Fuels is preparing four of its convention uranium mines production, CEO Mark Chalmers reported on Friday. Together, these mines have the ability to...

Canadian uranium miner Cameco’s financial performance continues to demonstrate the positive momentum experienced in the nuclear energy industry, CEO Tim Gitzel said on Tuesday, announcing improved...

After finding itself suddenly unwelcome in its traditional sphere of influence, France is casting further afield. That’s why president Emmanuel Macron will travel to energy-rich Central Asia this...

As prices of uranium continue to enjoy sustained increases, US-based Ur-Energy has witnessed a “dramatic increase” in request for proposals (RFPs) for uranium sales from utilities in the US, Europe...

Canadian mining company Cameco has signed a uranium supply agreement with China Nuclear International, a subsidiary of power group China National Nuclear Corporation (CNNC). The contract,...

Several hedge fund managers have started ratcheting up their exposure to uranium stocks, as they bet on significant price gains. Terra Capital’s Matthew Langsford, Segra Capital’s Arthur Hyde and...

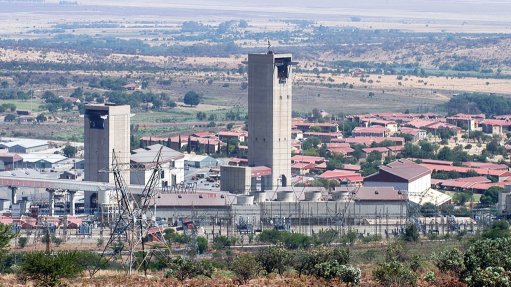

Shareholders of TSX-V-listed CanAlaska have approved the company’s plans to spin out its five nickel properties into a new subsidiary, Core Nickel. Core Nickel will focus on developing nickel...

Mining and exploration firm Madison Metals executive chairperson and CEO Duane Parham has increased his investment in the company, acquiring a further 233 000 shares on the open market. Prior to...

Australia-based Valor Resources on Tuesday announced the acquisition of a 500 km2 claim package around the Athabasca basin, in Canada. Valor stated that mineral claims represented an important...

Vancouver-based Q Battery Metals has staked the Gamart Strategic Metals property, located in the Caniapiscau region of northern Quebec. The project is an early-stage exploration target with...

Uranium developer Peninsula Energy has established a new uranium development project, the Dagger project, which boasts an initial mineral resource estimate of 6.9-million pounds of uranium oxide....

Canada’s NexGen Energy is looking to Australia’s equity market as it sets up financing for its first-ever uranium mine back home, a project with a $1-billion price tag. That’s partly because its...

Uranium exploration and development company IsoEnergy has completed its previously announced marketed private placement of subscriptions, raising gross proceeds of $36.6-million. The company...

ASX-listed Lotus Resources has received regulatory approvals, a key condition precedent to implementing its proposed schemes of arrangement with investor A-Cap, from the Botswanan authorities....

Australia-listed Paladin Energy’s interest in the Michelin exploration project, in Labrador, Canada, has increased to 100%, from 75% previously. As a result of the funding and dilution provisions...

ASX-listed Aura Energy has identified exploration targets to extend its Tiris project’s current resource, in Mauritania. The company said on Tuesday that preliminary work has identified seven...

ASX-listed DevEx will raise A$21.1-million in a share placement and fully underwritten entitlement offer to expand its exploration programmes in Western Australia and the Northern Territory....

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

Supplier & Distributor of the Widest Range of Accurate & Easy-to-Use Alcohol Breathalysers

VISIT SHOWROOMSmartMine IoT has been developed with the mining industry in mind, to provides our customers with powerful business intelligence and data modelling...

VISIT SHOWROOMWeir Minerals Europe, Middle East and Africa is a global supplier of excellent minerals solutions, including pumps, valves, hydrocyclones,...

VISIT SHOWROOMFor over 60 years, VEGA has provided industry-leading products for the measurement of level, density, weight and pressure. As the inventor of the...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation