Receive our free daily newsletter:

The Khan project, in Namibia, is becoming a valuable asset to Canadian-headquartered Madison Metals and has potential to contain new high-grade uranium discoveries, says chairperson and CEO Duane...

All mining and metals companies are being urged to embrace new guidance on reducing Scope 3 emissions, which was published by the International Council for Mining and Metals (ICMM) on Wednesday....

After reviewing a definitive feasibility study (DFS) on the Tumas uranium project, in Namibia, ASX-listed Deep Yellow has made positive reassessments of capital expenditure and the value of the...

The South African government will publish a request for proposals (RFP) for 2 500 MW of new nuclear capacity by March 2024, following the National Energy Regulator of South Africa’s (Nersa’s)...

Uranium exploration and development firm Madison Metals has successfully completed a private placement, issuing 1.15-million units at a price of C$0.40 a unit. The transaction generated about $460...

The US House voted Monday to approve legislation that would bar the importation of enriched Russian uranium, sending the measure to the Senate where it has support but limited time for passage this...

Energy Resources of Australia (ERA), Rio Tinto's majority-owned uranium unit, said on Tuesday it expects to record a bigger provision of about A$2.3-billionrelated to the rehabilitation of its...

Elevate Uranium, an ASX-listed company with assets in Namibia and Australia, on Friday announced a placement of shares to raise A$10-million. Demand for the placement, at A$0.32 a share, was...

Minerals explorer Atha Energy on Thursday announced that it would buy Latitude Uranium and 92 Energy to create a new uranium exploration company with assets spread across Canada’s three uranium...

Boss Energy, which is buying a stake in the Alta Mesa project in the US, has completed its bookbuild to raise A$205-million through a single tranche placement of new fully paid ordinary shares....

Legislation that would bar the import of enriched Russian uranium into the US has been teed up for a vote in the US House of Representatives. The Prohibiting Russian Uranium Imports Act, by...

The South African mining industry is years ahead of its international peers when it comes to local and community engagement, Australia-listed Jupiter Mines, which owns 49.9% of the Tshipi manganese...

NYSE- and TSX-V-listed enCore Energy has sold a 30% interest in its Alta Mesa project, in the US, to Australia’s Boss Energy for $70-million. Boss will pay $60-million for its interest, make an...

TSX-V IsoEnergy, under the leadership of CEO Philip Williams, has successfully closed the merger with Consolidated Uranium (CUR). This union not only marks a significant milestone for IsoEnergy,...

Uranium mining and exploration company Madison Metals has announced a private placement of units at a price of C$0.40 each for aggregate gross proceeds of up to C$500 000. Each unit will comprise...

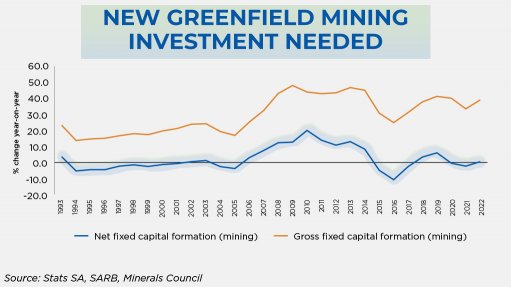

The growth of investment in fresh new greenfield mining projects is lagging badly and the contribution of the South African mining industry to the national economy has more than halved in the last...

NYSE American- and TSX-V-listed enCore Energy has restarted the previously producing Rosita central processing plant (CPP), marking the first step in the company’s south Texas production pipeline...

Exploration and development company Premier American Uranium (PUR), a spinout of Consolidated Uranium, will begin trading on the TSX-V on December 1. Backed by Sachem Cove Partners, Consolidated...

Uranium explorer Deep Yellow is making strides towards extending the mine life of its Tumas project to a targeted 30 years, with a recent drill programme unearthing additional resources to prolong...

The positive sentiment coursing back into the uranium industry is boding well for exploration company DevEx, which is drilling around an historical high-grade uranium mine in Australia, says...

South Africa has a pressing need to reawaken its public markets and the new Utshalo must be complimented for setting out to do just that. New mining capital raisings have become too few and far...

Diversified mining company African Rainbow Minerals (ARM) is supporting postdoctoral research into water, energy and digitalisation at the University of the Witwatersrand (Wits) in Johannesburg....

Uranium prices topped $80 a pound for the first time in more than fifteen years on renewed demand for nuclear power and disrupted supplies. Nymex futures tracking physical-market contracts for a...

Australia-listed Peninsula Energy on Monday announced a A$60-million equity raise to fund the restart of production at the Lance mine, in Wyoming – one of the biggest near-term uranium development...

If South Africa is not to be left out of the exploration boom, spurred by the immense mineral resources required to develop technologies needed to achieve net zero, it is imperative that the...

Renewables have become a critical part of metal mining thinking, the Sibanye-Stillwater Battery Metals Investor Day 2023 audience heard on Tuesday. “If you look at electricity, renewables are...

NYSE American-listed Uranium Energy Corp (UEC) has filed an initial economic evaluation for the Alto Paraná titanium project, in Paraguay, upgrading the resource, refining the technical approach to...

Australia-listed Macro Metals on Tuesday announced a binding option to acquire 85% of the lithium rights of the Aurora project in Oregon, US, from fellow-listed Aura Energy Metals. Nonexecutive...

Namibia- and Canada-focused uranium mining and exploration company Madison Metals has successfully renewed exclusive prospecting licence (EPL) 7011 in the Madison North project area, adjacent to...

Higher free cash flow, higher recovered grades, higher production and higher received gold price have been reported by Harmony Gold in its operational update for the three months ended September...

Research Reports

Projects

Latest News

Showroom

Yale Lifting Solutions is a leading supplier of lifting and material handling equipment in Southern Africa. Yale offers a wide range of quality...

VISIT SHOWROOMSupplier & Distributor of the Widest Range of Accurate & Easy-to-Use Alcohol Breathalysers

VISIT SHOWROOMWeir Minerals Europe, Middle East and Africa is a global supplier of excellent minerals solutions, including pumps, valves, hydrocyclones,...

VISIT SHOWROOMWeir Minerals Europe, Middle East and Africa is a global supplier of excellent minerals solutions, including pumps, valves, hydrocyclones,...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation