Receive our free daily newsletter:

Excellent progress has reportedly been made with the construction of the R2.5-billion gold tailings retreatment project, west of Johannesburg, on Gauteng’s West Rand. The continued momentum of the...

Collaborative investor-led initiative the Global Investor Commission on Mining 2030, also known as the Mining 2030 Commission, has, to date, gained the support of 82 investors with over...

New demand for platinum group metals (PGMs) may be created in the energy generation and storage field, Toronto- and New York-listed Platinum Group Metals (PTM) stated on Wednesday. The unique...

Iron-ore surged to its highest intraday price since February, with demand optimism growing as more details emerge about China’s latest economic stimulus drive. The steel-making staple rose as much...

After 38 years, the World Coal Association (WCA) has rebranded itself as FutureCoal – The Global Alliance for Sustainable Coal. FutureCoal CE Michelle Manook says the rebrand was done in response...

During 2023, platinum has benefited from stellar industrial demand reaching a record level, with 2024 heading for the third-highest industrial demand spot. Today's publication of the platinum...

The implementation of study tours aimed at boosting the acceleration of green hydrogen development in South Africa forms the core of a tender which closes on December 8. Mining Weekly can report...

Western lithium and graphite miners have started charging the electric vehicle (EV) supply chain higher prices for their material, meeting demand for environment-friendly and consistent supply that...

Green hydrogen produced on site can play a huge role in solving the energy crisis as it eliminates the challenges associated with establishing electrical distribution networks over vast distances,...

If South Africa is not to be left out of the exploration boom, spurred by the immense mineral resources required to develop technologies needed to achieve net zero, it is imperative that the...

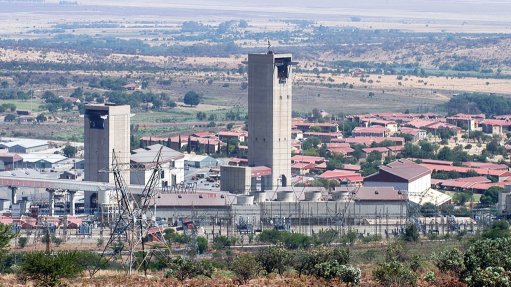

The South Deep gold mine west of Johannesburg, which is already benefitting from 50 MW of solar power commissioned last year, is poised to be boosted by another 50 MW to 80 MW of wind power going...

A green hydrogen pilot plant and refuelling station, to gain scientific insights into the upscaling green hydrogen technologies and to ensure a high safety level for the hydrogen economy, is to be...

In addition to physical safety, gold mining company Gold Fields said on Thursday that it is prioritising the mental health and wellbeing of its employees, following an independent workplace culture...

Over the past few years, international climate policy has been shaped largely by a close-knit group of politicians in the twilight of their careers. Now leaders from beyond the traditional...

South African ilmenite used to manufacture titanium dioxide pigment in KwaZulu-Natal has received a major value boost with the signing of an engineering, procurement and construction (EPC) contract...

More people work in the energy sector today than in 2019, almost exclusively because of the growth in clean-energy sectors, which have employed more workers than fossil fuels since 2021, a new...

Diversified miner Anglo American has launched a digital traceability solution called Valutrax, which is designed to provide customers with greater assurance about the provenance of the products...

Renewables have become a critical part of metal mining thinking, the Sibanye-Stillwater Battery Metals Investor Day 2023 audience heard on Tuesday. “If you look at electricity, renewables are...

Green hydrogen generation received a major boost on Tuesday with the introduction of a far-reaching iridium-thrifting breakthrough by Germany’s Heraeus Precious Metals in collaboration with South...

Commodities giant Glencore has finally agreed a deal with Canadian miner Teck Resources, which will sell its entire interest in its steelmaking business for $9-billion to a consortium led by the...

The auto industry's drive to make electric vehicle motors with little to no rare earth content has hit high gear, with European, US and Japanese automakers and suppliers racing for alternatives in...

In its second undertaking as the chair of the Kimberley Process (KP), the United Arab Emirates (UAE) has vowed to advance a number of crucial initiatives through to fruition. The KP is a United...

Higher free cash flow, higher recovered grades, higher production and higher received gold price have been reported by Harmony Gold in its operational update for the three months ended September...

When the world’s most important diamond buyers arrived at De Beers’ offices in Botswana late last month, they were presented with a rare offer by their host: the option to buy nothing at all. De...

Diversified chemicals solutions company AECI will increase focus on its core mining and chemicals capability and divest noncore businesses. The group aims to double the profitability of its core...

Palladium prices have tumbled to five-year lows below $1 000 an ounce this week, hastening a retreat triggered by expectations of surpluses due to the rapid spread of electric vehicles and...

Sizeable output cuts will help shore up nickel prices, which are likely to have reached a bottom after a year-long slide, but tighter supplies are not expected to eliminate surpluses. Specifically,...

Gold mining company AngloGold Ashanti is advancing decarbonisation projects at the Geita mine in Tanzania, has commenced renewable energy project works at the Tropicana mine in Australia, and a big...

Anglo American is seeking partners in the Middle East and Africa to do supply and distribution deals for fertiliser from its multibillion-dollar mining project in northeast England, a senior...

Cheap fossil fuels are holding up developing nations’ efforts to move toward green alternatives, highlighting the need to make clean sources more affordable if the world is to meet its climate...

Palladium dropped below $1 000 an ounce for the first time in five years as demand falters amid a slowdown in car sales, the rise of electric vehicles and as users switch to cheaper platinum. The...

Gold mining company AngloGold Ashanti has reaffirmed annual production guidance for 2023 after third-quarter gold production improved versus the second quarter, continuing the recovery from...

World Gold Council (WGC) member companies directly contributed $57-billion to host economies in 2022, as well as $570-million to local communities and indigenous groups in 34 countries, which shows...

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

FlameBlock is a proudly South African company that engineers, manufactures and supplies fire intumescent and retardant products to the fire...

VISIT SHOWROOMImmersive Technologies is the world's largest, proven and tested supplier of simulator training solutions to the global resources industry.

VISIT SHOWROOMAxFlow AQS Liquid Transfer (Pty) Ltd is an Importer and Distributor of Pumps in Southern Africa

VISIT SHOWROOMBooyco Electronics, South African pioneer of Proximity Detection Systems, offers safety solutions for underground and surface mining, quarrying,...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation