Receive our free daily newsletter:

Multinational mining and metals processing group Sibanye-Stillwater has approved the start of the second phase of its Keliber lithium project, which includes the construction of the concentrator...

If the 5 066 outstanding mining and exploration permits were approved, South Africa could begin to see a shift in the economy within 12 to 18 months, new Minerals Council South Africa CEO Mzila...

South Africa, with its incredible minerals endowment and extraordinary untapped potential, is definitely under-explored, Anglo American CEO Duncan Wanblad said in response to questions after...

Anglo American said it is cutting corporate office jobs across several countries, as unions said its South African iron-ore business plans to lay off scores of workers at its head office. The...

World-renowned conservationist Jane Goodall reminded hundreds of scientists present at the 12th Oppenheimer Research Conference in Midrand that if the world carries on with a business-as-usual...

Global gold industry membership organisation the World Gold Council (WGC) has appointed Sibanye-Stillwater CEO Neal Froneman as chairperson and DRDGold CEO Niël Pretorius as a director. Froneman...

The surplus in the global nickel market is expected to widen to 239 000 metric tons in 2024 from 223 000 tons this year, the International Nickel Study Group (INSG) said on Tuesday, signalling...

The emerald green of Zambia and the ruby red of Mozambique are continuing to give exceptional gemstone hues to Southern Africa, Mining Weekly can today report. Zambian emeralds, which are among the...

Higher temperatures and more intense storms haven’t changed the fundamental challenge of climate policy: Countries around the world must find politically feasible ways to zero out emissions without...

The European benchmark ferrochrome price for the fourth quarter of 2023 is $1.53/lb, 1.32% up on the third quarter of 2023, Merafe Resources advised its shareholders on Monday. The main focus of...

Mining giant BHP has noted that global collaboration a significant quantum of capital would be required in order to source the critical minerals needed to drive decarbonisation. Speaking at the...

It is too early to expect the start of a new sustaining upcycle for commodities, Macquarie states in its latest quarterly outlook for global commodity markets. In a nigh 100-page commodities...

Close to half a century of local manganese mastery by Manganese Metal Co of Mpumalanga is placing South Africa – a manganese mining and refining country – in pole position, amid a flurry of global...

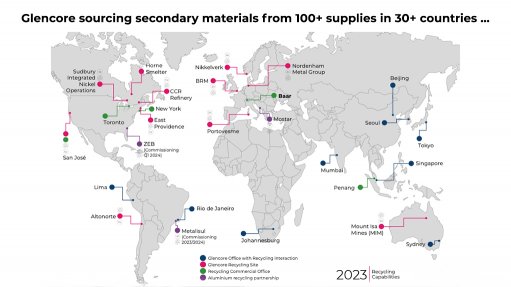

Although Glencore’s earnings contributions from recycling activities are not material at this stage, the growth potential to the diversified mining and marketing company from circular economic...

With a legacy spanning decades and a reputation for pioneering advancements, South Africa’s Bell Equipment is now placing strong new emphasis on advancing underground mining equipment. Currently a...

Uranium prices are likely to extend a blistering rally and end the year more than 50% higher as mounting worries over climate change accelerate a global shift to cleaner sources of energy including...

Platinum mines operated by Johannesburg Stock Exchange-listed diversified mining company African Rainbow Minerals (ARM) will be on the receiving end of clean power from a R2.5-billion solar plant...

The World Gold Council (WGC) has announced that its members, which account for the majority of the world's large-scale gold miners, have committed to taking steps towards providing enhanced...

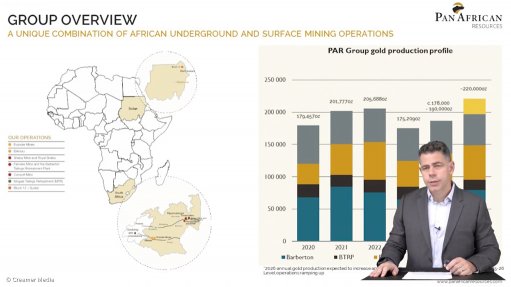

The pathway established by Pan African Resources towards achieving gold production of a quarter million ounces a year in 2026 is based on two organic growth prospects in the immediate future,...

GoldOre, a proudly South African private company founded by Adrian Singh 13 years ago, markets the worldwide patented and proprietary MACH Reactor technology that he invented. A hydrodynamic...

Gold markets haven’t been this calm since the onset of the Covid-19 pandemic, thanks to a deadlock between buyers and sellers that’s showing no signs of breaking. Six-month historical gold...

The London Bullion Market Association (LBMA) on Thursday called for proposals from service firms to create a secure global database that would improve trust in the gold market's value chain. Gold...

Diversified miner Rio Tinto’s Iron Ore Company of Canada (IOC) has announced a C$4-million donation, over two years to bilingual college Cégep de Sept-Îles in Quebec, for the construction of its...

Former Gold Fields CEO Chris Griffith has been appointed CEO of Vedanta Resources' Base Metals unit and president of its International Businesses, with effect from October 2. He will lead the...

The mining industry is working to boost freshwater recycling while also developing direct lithium extraction (DLE) technologies as it races to reinvent how the battery metal is produced for the...

South Africa’s sole listed copper producer Copper 360 (AltX CPR) has announced a significant upgrade of its mineral resources at the company’s Rietberg mine in the Northern Cape. The total resource...

The first 10 MW solar plant at Evander gold-mining operation of Pan African Resources is reducing group all-in sustaining costs (AISC) by more than $10/oz with this number set to increase in coming...

Iron-ore fell for the first time this week as a lull in China’s property sector persists, with fresh data showing a recent spurt in home sales in its capital losing momentum. Prices of the key...

Global mining company Barrick plans to double its copper output by the end of the decade and continue to increase its production of the metal to an estimated one-billion pounds, or 450 000 t/y, by...

Copper mining company Copper 360, which announced in August that its School of Mining was under development at Concordia operation in the Northern Cape, has launched its first set of courses, aimed...

The world’s producer of the purest manganese metal is becoming greener and cleaner as it repositions for market acceptance in the battery electric vehicle (BEV) market, where it sees phenomenal...

The United States and Saudi Arabia are in talks to secure metals in Africa needed to help them with their energy transitions, the Wall Street Journal reported on Sunday, citing people with...

For nearly 50 years Manganese Metal Company (MMC) has been buying high-grade manganese fines material from Hotazel in South Africa’s Northern Cape and turning it into a beneficiated manganese...

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

In 1958 John Deere Construction made its first introduction to the industry with their model 64 bulldozer.

VISIT SHOWROOMWe supply customers with practical affordable solutions for their testing needs. Our products include benchtop, portable, in-line process control...

VISIT SHOWROOMImmersive Technologies is the world's largest, proven and tested supplier of simulator training solutions to the global resources industry.

VISIT SHOWROOMFlameBlock is a proudly South African company that engineers, manufactures and supplies fire intumescent and retardant products to the fire...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation