Receive our free daily newsletter:

Battery metals miner Marula Mining has signed a binding term sheet with Kenyan manganese mine operator Gems and Industrial Minerals (GIM) to acquire a 60% commercial interest in the Larisoro mine,...

Johannesburg Stock Exchange-listed mining company Northam Platinum on Friday declared a cash interim dividend after reporting strong performance from all group operations in the six months to the...

Platinum group metals (PGM) mining, refining, and marketing company Implats, which reported solid production in a low-price environment on Thursday, is ironically still experiencing strong demand...

Ahead of new diamond import requirements from Group of 7 (G7) nations, starting on March 1, diamond producer De Beers Group says it anticipates no disruption to its diamond supply. The group...

A phased reduction in group output owing to a probable decline in production from Impala Canada and Mimosa in Zimbabwe is likely from platinum group metals (PGMs) mining and marketing company...

Russian gold producer Polyus's net profit rose 12% to $1.7-billion last year thanks to increased production and sales, it said on Thursday, but it expects lower gold output in 2024 and warned that...

London-listed Galileo Resources has met all conditions required to acquire an additional 51% shareholding in BC Ventures, which, coupled with its existing 29% shareholding, now adds up to an 80%...

Aim-listed phosphate miner Kropz has appointed chartered accountant Werner Greyling to succeed Louis Swart as financial manager, with effect from March 1. Swart will, however, assist the company in...

Johannesburg- and London-listed diversified mining and marketing company Anglo American announced on Thursday that jointly owned renewable energy venture with EDF Renewables, Envusa Energy, has...

Vancouver-based SSR Mining has retracted its previously issued 2024 and long-term guidance forecasts for the Çöpler mine, in Türkiye, following a significant slip on the heap leach pad earlier this...

The significant decline in platinum group metal (PGM) prices during 2023 has resulted in notably lower group profitability, despite disciplined cost control across several operations, PGMs mining...

Green electrons are being generated as planned at Harmony Gold’s 30 MW first phase of renewable energy generation, which is now fully integrated into the mining company’s Tshepong South and North...

The board of mining company Harmony Gold has approved the commencement of a R7.9-billion life-of-mine (LoM) extension project at the rich Mponeng gold mine in the West Wits region of South Africa's...

Nickel ore prices in Indonesia, the world's top producer, have risen on tighter supply after government delays in issuing new mining quotas that has also prompted smelters to curb production,...

Russia's sanctions-hit diamond producer Alrosa on Wednesday reported 2023 net profit of 85.18-billion roubles ($925-million), down 15.2% from the previous year. Turnover was up 9.2% at...

Russia's new silver mine Prognoz, one of two major projects coming online around the world this year, will start selling silver concentrate in the third quarter of 2024, its owner told Reuters on...

The contribution of diversified mining company Anglo American to a cleaner, greener maritime industry is highlighted by this week’s delivery of the last of ten emission-cutting ships. The maiden...

Green hydrogen development company Lhyfe is planning to build, if plans are approved, a 20 MW green hydrogen production facility in Wallsend, North Tyneside, in the UK. The proposed facility will...

ASX- and Aim-listed Aura Energy’s recently completed front end engineering design (FEED) study for the Tiris uranium project, in Mauritania, has confirmed “excellent” economic returns, the company...

Scandinavia-based gold exploration and mining company Akobo Minerals, which has operations in Ethiopia, has finalised an agreement regarding completion of its debt restructuring. This follows the...

Toronto-listed Euro Sun Mining, headed by South African CEO Grant Sboros, is advancing a development-stage gold and copper project in Romania, a country which is reportedly shedding its rigidly...

Hive Hydrogen South Africa has signed an agreement with Genesis Eco-Energy to implement 372 MW of wind power in the Western Cape, in support of the development of its R105-billion green ammonia...

Many of the world’s biggest nickel mines are facing an increasingly bleak future as they wake up to an existential threat: a near limitless supply of low-cost metal from Indonesia. With roughly...

London-listed rare earths project developer Pensana, through its 84%-owned subsidiary Ozango Minerais, which owns 100% of the Longonjo project, in Angola, has concluded a nonbinding term sheet...

Sub-Saharan African miner BCM International Group has uncovered gold mineralisation grading 256 g/t from outcrop sampling and 25.1 g/t gold from pit sampling over a 3-km-long target on the Mbe gold...

Australian researchers have made a step forward in addressing perhaps the biggest single obstacle to the large-scale roll-out of the hoped-for hydrogen economy: hydrogen embrittlement. This is the...

The underwhelming results from two of the largest global multinational mining and commodity companies Anglo American and Glencore, which both released their 2023 financial and preliminary results...

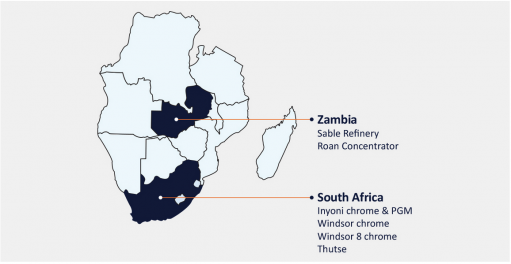

The copper operations in Zambia of South Africa’s Jubilee Metals showed strong growth in the six months to December 31, with further sharp increases expected going forward. The Johannesburg- and...

JSE- and NYSE-listed Sibanye-Stillwater has reported a 55.1% increase in attributable lithium mineral resources as at the end of last year, along with a general expansion and diversification of its...

South Africa’s rare earths project in Limpopo has received a distinctly possible lifespan boost to more than 16 years following an updated bulk density calculation, which has enlarged the likely...

Trade ministers from nearly every country in the world gathered in Abu Dhabi on Monday for a World Trade Organization meeting that aims to set new global commerce rules, but even its ambitious...

The latest round of Russia sanctions unveiled Friday targeted hundreds of people and entities from around the globe, including a Liechtenstein company that traded precious metals, a semiconductor...

Aim-listed Xtract Resources has concluded the disposal of its entire interest in the Manica gold project, in Mozambique. The company in January agreed terms for the disposal of its 23% net profit...

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

ESAB South Arica, the leading supplier of high-end welding and cutting products to the Southern African industrial market is based in...

VISIT SHOWROOMBooyco Electronics, South African pioneer of Proximity Detection Systems, offers safety solutions for underground and surface mining, quarrying,...

VISIT SHOWROOMBooyco Electronics, South African pioneer of Proximity Detection Systems, offers safety solutions for underground and surface mining, quarrying,...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation