Receive our free daily newsletter:

Indonesia, a major thermal coal exporter, aims to produce 710-million metric tons of coal in 2024, the Mining Minister said on Monday, after posting record output last year. Indonesia's coal...

Diversified mining company Eurasian Resources Group (ERG) is pursuing the development of a refinery to process cobalt hydroxide into cobalt sulphates, the primary form of supply for cobalt-bearing...

Copper rose from its lowest close since mid-December, as inflation data from China bolstered calls for stronger stimulus measures from Beijing. China’s consumer prices posted their longest streak...

Critical mineral demand is growing significantly at a time when South Africa has a pressing need to reawaken its public markets – two crucial needs that can be fulfilled in one go by companies...

Chinese mining firm Zijin Mining Group will acquire a 15% stake in Solaris Resources for about C$130-million, the Canadian miner said on Thursday. Zijin Mining Group plans to take a 15% stake in...

China's iron-ore imports in 2023 hit a record high, up 6.6% from a year before, customs data showed on Friday, thanks to stronger demand amid a lack of government-mandated steel output caps and...

China's imports of Mongolian coking coal may rise to a record in 2024, after more than doubling in 2023, on improving transport links and its lower price versus domestic and international supplies,...

China's exports of rare earths in 2023 rose 7.3% from the prior year, customs data showed on Friday, boosted by competitive prices and growing overseas demand from electric vehicle makers and other...

Research firm BMI has revised downward its nickel price forecast for this year to $20 000/t from $20 600/t as the market remains in a supply glut. Simultaneously, weak Mainland Chinese demand and...

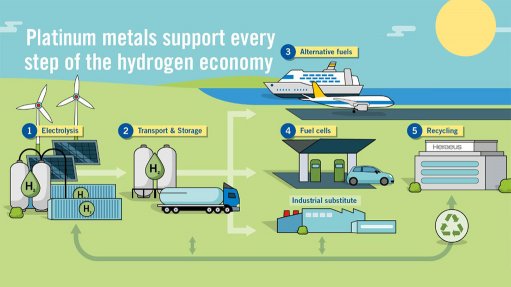

The hydrogen economy is an important new growth area for platinum group metals (PGMs) and, in turn, PGMs are pivotal for hydrogen production and application across a broad front. Accentuating this...

A major new initiative by long-standing South Africa associate Heraeus Precious Metals this week drew renewed and intensified attention to the widespread role of platinum group metals (PGMs) in the...

As climate diplomats at COP28 in Dubai debated an agreement to transition away from fossil fuels last December, India was facing another energy conundrum: It needed to build more power capacity,...

Johannesburg- and New York-listed mining company Sibanye-Stillwater has appointed Melanie Naidoo-Vermaak as chief sustainability officer, effective January 1. “Sustainability/ESG is a strategic...

Palladium prices fell by 3% on Thursday as concern the take-up of electric vehicles will destroy long-term demand unravelled some of the December gains that followed Britain's expansion of...

China’s CMOC Group boosted its cobalt output by more than 170% last year, with surging production at a new mine in the Democratic Republic of Congo helping the company leapfrog Glencore as the...

China has restored import levies on coal from the beginning of the year, a move that could threaten Russian exporters dependent on the world’s largest market for the fuel. The tariffs were removed...

The amount of bank financing going to mining coal, the dirtiest fossil fuel of them all, remains at surprisingly high levels. Most of it is coming from China. A new report from researchers at...

Giyani Metals is a company listed on the TSX Venture Exchange in Toronto, Canada. Through its wholly-owned Botswana subsidiary Menzi Battery Metals, Giyani is the owner of the past producing K.Hill...

Australia wants to compete with China in producing and refining resources vital to the next phase of high-tech manufacturing around the world, according to Minister Madeleine King, backing the...

India has urged the Group of Seven (G7) countries to delay an incoming ban on Russian diamonds because the rules to trace the origins of gems remain unclear, two sources aware of the matter said....

Diamond miner De Beers' final sales cycle of this year has generated $130-million, an improvement on the $86-million in sales recorded in the ninth sales cycle of this year. Sales were, however,...

Gold mining company AngloGold Ashanti is taking steps to become part of a search for gold in Guyana, a country on South America’s North Atlantic coast. The New York- and Johannesburg-listed...

Australia-headquartered Woodside Energy has signed a nonbinding memorandum of understanding (MoU) with four Japanese companies to enable studies of a potential carbon capture and storage (CCS)...

The application of State electricity utility Eskom for a six-year negotiated pricing agreement for the Glencore-Merafe ferrochrome smelter operation in Rustenburg, in the North West Province, has...

Singapore-based start-up Atomionics has rolled out its technology that uses gravity and artificial intelligence to define ore bodies to its first customer, which the company says could cut costs...

Chile's SQM has teamed up with Australia's richest person, Gina Rinehart, to make a sweetened A$1.7-billion ($1.14-billion) bid for Australian lithium developer Azure Minerals, the three parties...

Lithium buyers are sounding cautious on the key battery metal’s prospects for next year, even after a huge plunge in prices. Producers have recently been in talks with clients — mostly in Asia — to...

Overwhelming demand and declining South African mining supply are poised to result in a very substantial rise in the price of platinum, Dr David Davis forecasts. Davis has been associated with the...

Global efforts to boost clean energy and rein in carbon emissions have had a clear impact on coal: consumption of the dirtiest fossil fuel is expected to peak this year. Total consumption of coal...

Copper prices need to nearly double in order to prompt mining companies to build costly mines to meet rising demand for critical materials, according to billionaire Robert Friedland. The mining...

India's Surat diamond bourse will create 150 000 new jobs and become a "one-stop shop" for artisans and businessmen, Prime Minister Narendra Modi said as he inaugurated the new bourse in Gujarat....

The building of the R105-billion green ammonia project by Hive Hydrogen South Africa is poised to be a huge economic uplift for the Eastern Cape. The large project is the first phase of a...

S&P Global Ratings on Thursday downgraded the rating of Vedanta Resources, parent of Indian miner Vedanta, citing concerns about extension of maturities of some of its bonds. Vedanta Resources...

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

Booyco Electronics, South African pioneer of Proximity Detection Systems, offers safety solutions for underground and surface mining, quarrying,...

VISIT SHOWROOMOur Easy Access Chute concept was developed to reduce the risks related to liner maintenance. Currently, replacing wear liners require that...

VISIT SHOWROOMGoodwin Submersible Pumps Africa is sole distributors for Goodwin electrically driven, submersible, abrasion resistance slurry pumps.

VISIT SHOWROOMEducation: Consulting with member companies to obtain the optimal benefits from their B-BBEE spending, skills resources as well as B-BBEE points

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation