Oil Search refocuses on Alaska

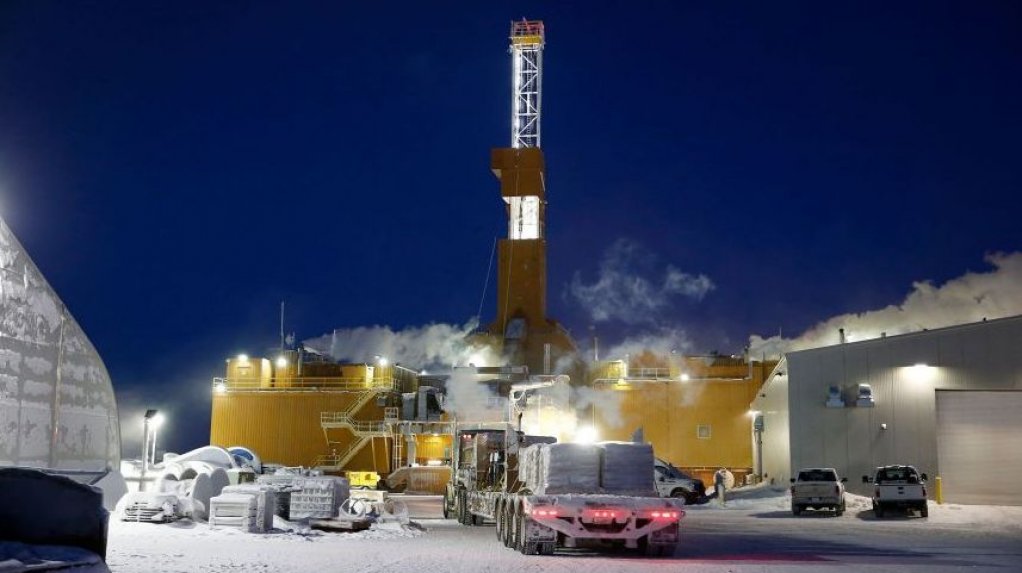

PERTH (miningweekly.com) – ASX-listed Oil Search has announced a renewed focus on its Alaskan projects as part of its response to the changing market environment, with first oil at the Pikka project targeted for 2025.

MD Dr Keiran Wulff told investors on Thursday that the challenges posed by the Covid-19 pandemic and oil price downturn, combined with global trends and societal expectations, have been the catalyst for Oil Search to review its past performance and make sustained improvements to position the company for long-term success.

“We now have a lower cost base, are more resilient and are in a strong position to commercialise our world class resource base. Most importantly, these changes have been achieved while delivering record safety performance and stable production, as well as enhancing employee engagement and maintaining our commitment to our communities.”

Wulff said that Oil Search was adamant on delivering low cost, low greenhouse gas intensity, high value energy, with its strategy comprising three phases, including a focus on driving sustained low cost and simplification of its Papua New Guinea operations, commercialising its Pikka development at a breakeven cost of supply of less than $40/bl and prioritizing the develop of Papua liquefied natural gas (LNG), and by achieving full potential from the Alaskan assets, while also considering targeted complementary energy investments.

“We have learned some hard lessons this year. We are focused on delivering near-term operating cash flow and strong returns underpinned by resilient and disciplined capital management.

“We have a clear hierarchy for allocating capital, prioritizing sustaining capital and a strong, flexible balance sheet. We have stress tested our portfolio, instilled a disciplined approach to investment decisions and are well progressed in pursuing multiple options to ensure funding readiness for delivery of Pikka and Papua LNG,” said Wulff.

“The quality of our portfolio and the discipline being applied will underpin the delivery of our strategy.”

The company on Thursday said that a final investment decision for Pikka Phase 1 is targeted for late 2021, with first oil targeted for 2025.

Oil Search noted that it has completed optimisation efforts at Pikka, and subject to oil prices, the joint venture is preparing to proceed into front-end engineering design (FEED) in early 2021 with the Phase 1 project, based on a single drill site development with a production capacity of 80 000 bbl/d.

The initial project cost is expected to be less than $3-billion, and Pikka is expected to produce oil at a breakeven cost of supply of less than $40/bl. Oil Search noted that following detailed engineering and value optimisation studies, material cost savings have been achieved at Pikka by using a modular, truckable process facility design, allowing the project to start production from the Pikka field using a facility that met initial processing requirements, with the ability to add capacity as subsequent phases of the project are undertaken.

Aligned with the Pikka FEED entry in the first quarter of 2021, Oil Search was also planning to launch a formal divestment process, either solely or in cooperation with its joint venture partner, with the intent of selling 15% of its interest in Pikka and other key Alaskan assets.

Oil Search on Thursday also reported a 33% increase in the 2C contingent resource in Alaska, taking its total gross Alaskan North Slope 2C resource from 728-million barrels of oil to 968-million barrels of oil.

The increase reflected Oil Search’s positive achievements since the acquisition of the assets in 2018, with gross 2C oil resources now 93% higher than the original 500-million barrels of oil initially estimated.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation