Glencore studying an approach for Anglo American, sources say

LONDON - Commodities group Glencore is studying an approach for Anglo American, two sources said, a development that could spark a bidding war for the 107-year old mining company.

Glencore has not yet approached Anglo, one of the sources said. The discussions are internal and preliminary at this stage and may not result in an approach, the source added.

"We do not comment on market rumour or speculation," a Glencore spokesperson said.

Anglo on Friday rejected a $39-billion all-stock proposal from the world's No. 1 miner BHP.

BHP's proposed premium was 31% above Anglo's closing price on April 23.

A source familiar with the matter previously told Reuters that the Australian mining giant is considering making an improved offer. It has until May 22 to make a formal bid.

US shares of Anglo American rose after the news, closing up 6.5% on the session. Glencore’s US shares fell 1%.

Anglo is attractive to its competitors for its prized copper assets in Chile and Peru, a metal used in everything from electric vehicles and power grids to construction, whose demand is expected to rise as the world moves to cleaner energy and wider use of AI.

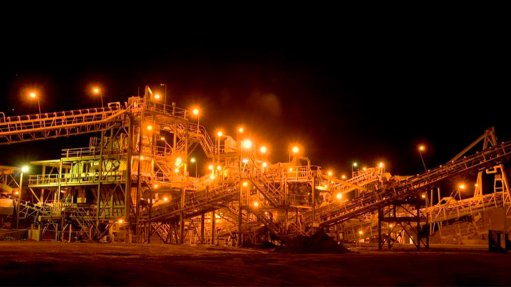

Anglo American and Glencore each own 44% of the Collahuasi mine in Chile, estimated to have some of the world's largest reserves of copper.

At the same time, Anglo's sprawling portfolio also includes platinum, iron ore, steelmaking coal, diamonds and a fertiliser project.

Anglo's share price has jumped since the offer was made public.

Before that, the miner had underperformed its peers following production downgrades and writedowns that led to a strategic review of its assets in February.

Glencore is still in the middle of a $6.9-billion acquisition of 77% of Canadian miner Teck's coal unit, which it expects to close by the third quarter this year.

A precondition of BHP's proposal was that Anglo sell its shares in Anglo Platinum (Amplats) and Kumba Iron Ore in South Africa, a country the world's largest listed company exited in 2015.

In a statement on May 2, BHP said that the proposal "reflects the priorities for its portfolio and opportunity for synergies."

Glencore owns coal and chrome assets in South Africa.

"Unlike BHP, Glencore could benefit from keeping Kumba and marketing iron ore, and Glencore may face less political pushback in South Africa, especially if it were to propose a straightforward all-share deal that does not include Kumba and Amplats demergers," Jefferies analyst Christopher LaFemina said in a research note on April 29, where he assessed different takeover scenarios for Anglo American.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation