Pan African confident of meeting upper end of full-year production guidance

South African gold producer Pan African Resources has revised its full-year production guidance to between 186 000 oz and 190 000 oz, compared with previous guidance of 180 000 oz to 190 000 oz, while maintaining its all-in sustaining cost guidance at between $1 325/oz and $1 350/oz.

In an update to shareholders about the group's production expectations for the full financial year to end June 30, it says it ceased processing of marginal surface sources at Evander Gold Mines during the second half of the financial year, as the processing of this material was becoming uneconomical.

It points out that the processing of the marginal surface sources at Evander contributed 2 500 oz to production in the first half of the financial year and that, if production from these sources is maintained throughout the second half of the financial year, group output will exceed 190 000 oz for the full-year.

"We are pleased that Pan African will achieve the upper end of our full-year production guidance, and would have exceeded guidance had we continued with the processing of surface material at Evander in the second half of the financial year. The robust production results, combined with record rand gold prices, should see the group deliver an excellent financial performance for the year," CEO Cobus Loots comments.

Pan African has, meanwhile, set its production guidance for 2025 at between 215 000 oz and 225 000 oz.

MTR PROJECT ON TRACK

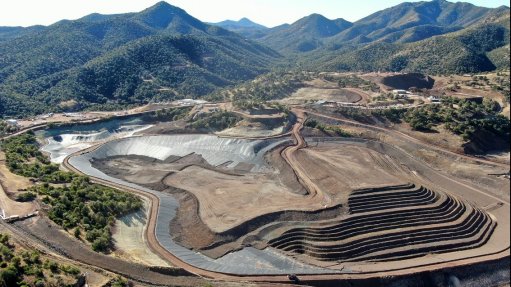

Pan African further reports that its Mogale Tailings Retreatment (MTR) project remains on schedule for commissioning and steady-state production in December. The company also does not expect any expenditure overruns for the project.

The company has updated the project's financial model to include the latest operating cost and production estimates, forecast rand:dollar exchange rate and dollar gold price.

The updated model is based on an exchange rate of R19 to the dollar, compared with the R15.50 to the dollar used in an earlier definitive feasibility study (DFS), while the gold price forecast has increased to $2 200/oz, compared with the $1 750/oz used in the DFS.

As a result of these changes, the project's pre-tax net present value (NPV) has increased to $183-million, from $63-million in the DFS, while the ungeared real internal rate of return has increased to 41.7%, from 20.1% in the DFS.

The payback on upfront capital investment of about $135.1-million has reduced to about two years, compared with the three-and-a-half years estimated in the DFS.

Further, Pan African in March completed an internal prefeasibility study (PFS) for the Soweto Cluster resource, which forms part of the MTR project.

The PFS considered numerous options, with the most feasible being the development of remining, overland piping and pumping infrastructure at the Soweto cluster resource to process the material at the MTR plant, Pan African notes.

It shows that the addition of the 110-million-tonne Soweto Cluster mineral resource has the potential to increase MTR production to about 60 000 oz/y over a 21-year LoM. A total additional capital requirement of $113-million will be required, with about $83-million to be incurred from year four to six and $29-million in year ten of the MTR's operation.

At a gold price of $2 200/oz and an exchange rate of R19 to the dollar, the pre-tax NPV combined for the Mogale and the Soweto Cluster is $283-million, representing an increase of $96-million, relative to Mogale's updated standalone financial model.

Pan African says it will now proceed with the necessary permitting and servitudes required for the remining and processing of the Soweto Cluster, with a final investment decision in due course.

"Our MTR project remains on schedule and on budget, and we look forward to commissioning it later in 2024. We have now demonstrated that the addition of the Soweto Cluster resources further improves the economic attractiveness of this world-class project," Loots says.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation