Photo by: Platinum Group Metals

Name of the Project

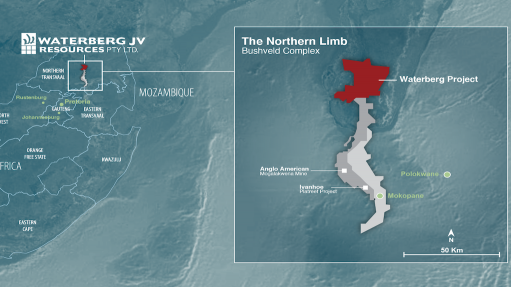

Waterberg platinum group metals project.

Location

About 85 km north of Mokopane, in Limpopo, South Africa.

Project Owner/s

Waterberg Joint Venture (JV) Resources, or Waterberg JV Co, a JV between Platinum Group Metals, or PTM (37.05%), Impala Platinum Holdings, or Implats (15%), Japan Oil, Gas and Metals National Corporation, or Jogmec (12.195%), Hanwa Co (9.755%) and black economic-empowerment partner Mnombo Wethu Consultants (26%). As a result of PTM's 49.90% ownership in Mnombo, the company has an effective interest in the Waterberg JV of 50.02%.

Project Description

The 2019 definitive feasibility study (DFS) mine plan envisages production of 4.8-million tonnes of ore a year and 420 000 platinum, palladium rhodium and gold, or 4E, ounces a year in concentrate.

The mine will initially access the orebody using two sets of twin decline tunnels, with fully mechanised longhole stoping methods and paste backfill used for mining. Paste backfill allows for a high mining extraction ratio, as mining can be completed next to backfilled stopes without leaving internal pillars.

Maintaining safety and reliability are key mine design criteria. As a result of the scale of the orebody, bulk mining on 20 m to 40 m sublevels using large underground equipment, and conveyors for ore and waste transport, will provide high efficiency.

Potential Job Creation

The project will create about 1 100 new highly skilled jobs.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $982-million and an internal rate of return of 20.7%. This is based on the 2019 DFS prices of palladium $1 546, platinum $980, gold $1 548 and rhodium $5 036 ($/R:15).

Capital Expenditure

Capital expenditure is estimated at $874-million, including $87-million in contingencies. Peak project funding is estimated at $617-million, based on 2019 commodity prices and costs.

Latest Developments

PTM spent $1.06-million on the Waterberg project in the three months ended November 30, 2022, taking its total expenditure on the project to $41.5-million since inception.

Total expenditures on the property since inception from all investor sources reached $81.5-million at the end of November.

PTM, alongside project partners, remains focused on advancing the project to a development and construction decision.

The partners have approved an in-principle preconstruction work programme valued at $21-million, which is set to be undertaken over 23 months ending August 31, 2024.

The programme involves initial road access, water supply, essential site facilities, a first phase accommodation lodge, a site construction power supply from Eskom, and advancement of the Waterberg social and labour plan.

An initial $2.5-million will be spent by the end of March this year.

PTM also plans to update the 2019 Waterberg DFS, including a review of cutoff grades, mining methods, infrastructure plans, scheduling, concentrate offtake, dry stack tailings, costing and other potential revisions to the project’s financial model.

The company is considering commercial alternatives for mine development, financing and concentrate offtake. Obtaining reasonable terms for Waterberg concentrate offtake from an existing smelter or refiner in South Africa is considered the preferred option and discussions with such parties are ongoing.

As an alternative to a traditional concentrate offtake arrangement, PTM is also considering the economic feasibility of building a matte furnace and base metal refinery to process Waterberg concentrate, which will be a separate business from the Waterberg JV.

Key Contracts, Suppliers and Consultants

Stantec Consulting International and DRA Projects SA (DFS).

Contact Details for Project Information

PTM, tel +27 11782 2186 or email info@platinumgroupmetals.net.