Name of the Project

Waterberg platinum group metals project.

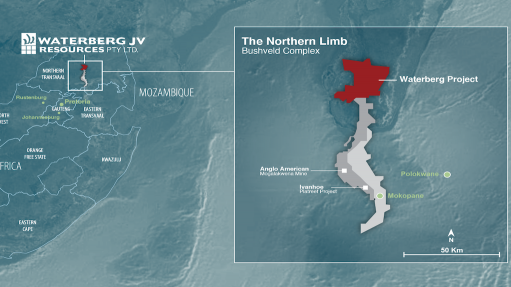

Location

The Waterberg project is located 85 km north of Mokopane, in Limpopo, South Africa.

Project Owner/s

Waterberg Joint Venture (JV) Resources, or Waterberg JV Co, a JV between Platinum Group Metals, or PTM (37.05%), Impala Platinum Holdings (Implats) (15%), Japan Oil, Gas and Metals National Corporation (12.195%), Hanwa Co (9.755%) and black economic-empowerment partner Mnombo Wethu Consultants (26%). As a result of PTM's 49.90% ownership in Mnombo, the company has an effective interest in the Waterberg JV of 50.02%.

Project Description

The 2019 definitive feasibility study (DFS) mine plan envisages production of 4.8-million tonnes of ore a year and 420 000 platinum, palladium rhodium and gold, or 4E, ounces a year in concentrate.

The mine will initially access the orebody using two sets of twin decline tunnels, with fully mechanised longhole stoping methods and paste backfill used for mining. Paste backfill allows for a high mining extraction ratio, as mining can be completed next to backfilled stopes without leaving internal pillars.

Maintaining safety and reliability are key mine design criteria. As a result of the scale of the orebody, bulk mining on 20 m to 40 m sublevels using large underground equipment, and conveyors for ore and waste transport, will provide high efficiency.

Potential Job Creation

The project will create about 1 100 new highly skilled jobs.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $982-million and an internal rate of return of 20.7%. This is based on the 2019 DFS prices of palladium $1 546, platinum $980, gold $1 548 and rhodium $5 036 ($/R:15).

Capital Expenditure

Capital expenditure is estimated at $874-million, including $87-million in contingencies. Peak project funding is estimated at $617-million, based on 2019 commodity prices and costs.

Latest Developments

PTM has signed a memorandum of understanding (MoU) with fellow shareholder Jogmec to accelerate financing opportunities for the project.

During a meeting on the sidelines of the Investing in African Mining Indaba, held in Cape Town, on May 10, representatives of Jogmec and PTM discussed finance and development plans for the project, with Jogmec expressing its intention to maintain its interests in the project and support funding contributions for development.

PTM president and CEO Frank Hallam has said that the company is encouraged by the declaration of support from its Japanese partners.

“The current geopolitical situation has reinforced the importance of establishing a secure and ethically sourced supply of platinum and palladium for the world.”

Key Contracts, Suppliers and Consultants

Stantec Consulting International and DRA Projects SA (DFS).

Contact Details for Project Information

PTM, tel +27 11782 2186 or email info@platinumgroupmetals.net.