Photo by: Calidus Resources

Name of the Project

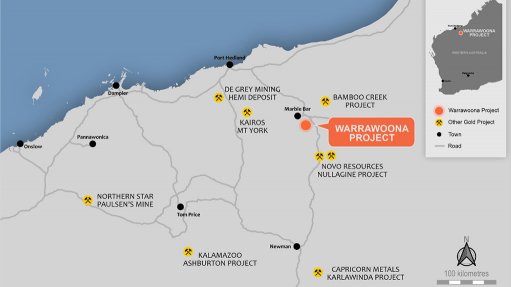

Warrawoona gold project.

Location

Pilbara, Western Australia.

Project Owner/s

Calidus Resources.

Project Description

The Warrawoona project is a high-margin gold operation, with average gold production estimated at 90 000 oz/y over an initial eight-year mine life.

The project has a global resource of 43.7-million tonnes grading 1.06 g/t gold for 1.5-million ounces.

The project includes a two-million-tonne-a-year conventional carbon-in-leach processing circuit with a single-stage crushing and semiautogenous grinding mill.

Calidus’ acquisition of the high-grade Blue Spec mine provides immediate opportunity to expand production and free cash flow at the project. The definitive feasibility study and integration plan are being undertaken in parallel with the construction of Warrawoona.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of A$408-million and an internal rate of return of 81%, with a payback of 13 months.

Capital Expenditure

The project has a capital cost of $120-million, including contingency and preproduction mining costs.

Planned Start/End Date

The project is expected to pour first gold in the first half of 2022.

Latest Developments

Calidus Resources poured 8 916 oz of gold in the June quarter during the commissioning and ramp-up of the Warrawoona gold project, with an additional 1 192 oz of gold in circuit.

First gold was poured in May, following the completion of the processing plant commissioning.

The gold produced to date has reconciled the resource and grade control models and resulted in the first debt repayment of A$3-million made to financial services provider Macquarie Bank as scheduled.

Milling rates also progressed throughout the June quarter and were expected to reach the nameplate capacity of 2.4-million tonnes a year in July.

Calidus reported a total of 327 000 t of low-grade ore, commissioning ore and run-of-mine ore milled during the quarter.

The process plant has been tested at up to 2.8-million tonnes a year, with no major bottlenecks identified, Calidus has said.

Mining has rapidly progressed, with 20 000 bank cubic metres (BCM) a day movement achieved, against an average requirement of 18 500 BCM/d. A new excavator and additional manning are to be mobilised in July to ensure that the BCM movement is maintained.

Liquefied natural gas storage vessels have been delivered to site, with a transition to gas-fired electricity expected in July.

Key Contracts, Suppliers and Consultants

Optiro Consultants, Lynn Widenbar and Associates (mineral resource estimate); Rapallo, Biologic, Woodman, Sticks and Stones, Total Heritage, Nyamal Heritage, Bat Call, Graeme Campbell and Associates, Mine Earth, Lloyd George Acoustics (environmental base line studies and project permitting); Peter O’Bryan and Associates, ATC Williams (geotechnical); ATC Williams (tailings storage facility); Groundwater Resource Management, or GRES (hydrology and hydrogeology); GR Engineering Services (processing plant); GRES, Metallurgy Management Services, Nagrom, ALS, BV (metallurgy and testwork); GRES, Aerodrome Management Services (infrastructure); Intermine Engineering Consultants, Entech and Galt Mining (mining); Macmahon Holdings (openpit mining and tailings dam); GRES (process plant engineering, procurement and construction contract); Rangecon (village install); and Telstra (communication).

Contact Details for Project Information

Calidus Resources, email info@calidus.com.au.