Name of the Project

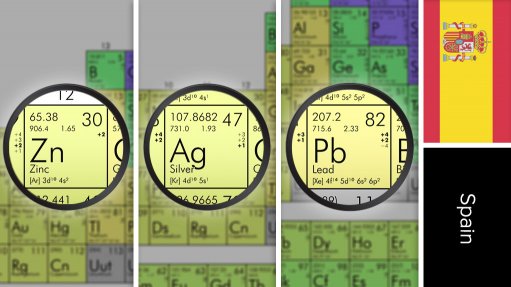

Toral lead/zinc/silver project.

Location

North-west Spain.

Project Owner/s

Europa Metals.

Project Description

A preliminary economic assessment (PEA) has shown that the project could be a significantly larger operation than previously contemplated.

The study envisages a 700 000 t/y operation over a 12-year life. The proposed operation is based on a 17-million-tonne-a-year resource at 6.7% zinc equivalent, including an indicated resource of 3.8-million tonnes at 8.1% zinc equivalent.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a net present value, at an 8% discount, of $156-million and an internal rate of return of 31.3%.

Capital Expenditure

Upfront capital required is estimated at $79-million.

Planned Start/End Date

Not stated.

Latest Developments

Canada-based Denarius Metals has been granted a definitive option agreement to acquire, in two stages, up to 80% in Europa Metals’ Toral project.

Denarius executive chairperson and CEO Serafino Iacono has said that the company is pleased to expand its scale in Spain through a partnership with Europa.

A mining application will be submitted for a mining licence at the project, thereby advancing the project towards potential future development. In subsequent years, Denarius will aim to expand the footprint of the project to encompass the nearby historic third-party Antonina mine and delineate further high-grade mineral resources, following the success of Europa’s recent drillholes.

Pursuant to the definitive agreement, Denarius has been granted a first option, exercisable until November 22, 2025, to subscribe for a 51% equity interest in Europa Metals Iberia (EMI) by spending, as operator, $4-million on the Toral project over the three-year period, completing a preliminary economic assessment and completing and submitting a mining licence application to the local Junta by July 31, 2023.

The proposed transaction is subject to approval by Europa’s shareholders and, once obtained, Denarius will make an initial payment of $100 000 to EMI, followed by a second aggregate sum of $550 000, to be made in periodic payments at the discretion of Denarius following completion of financing by the company.

Denarius’ expenditure commitment under the first option is subject to a minimum of $1-million in each of the first two years of the first-option period.

In addition, the definitive agreement provides Denarius with a second option to acquire an additional 29% equity interest in EMI by delivering a prefeasibility study and making a cash payment of $2-million to Europa within the 12-month period following the closing of the first option.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Europa Metals, tel +61 8 9486 4036 or email info@europametals.com.