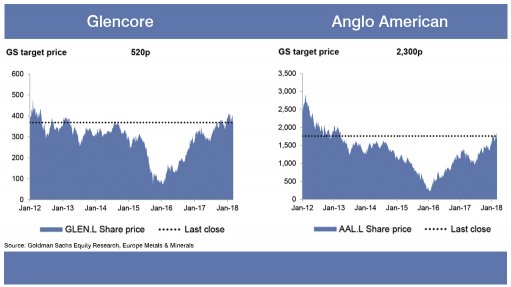

Share prices of Glencore and Anglo at 2013 levels, despite higher earnings, lower debt

Photo by: Goldman Sachs

JOHANNESBURG (miningweekly.com) – The so-called 'South Africa discount' that has dogged and diminished the share prices of mining companies operating in South Africa for decades, has been declared "unwarranted" by Goldman Sachs Europe Metals & Mining Equity Research analysts, against the backdrop of the winds of political change bringing with them lower operational risk.

In a 70-page note that anticipates a rerating for Johannesburg Stock Exchange-listed mining multinationals Glencore and Anglo American, analysts Eugene King, Abhinandan Agarwal, Felix Schlueter and Peter Hackworth state that they expect the unjustified discount to close, and reiterate a 'buy' rating on Glencore and an upgrade on Anglo from neutral to buy.

"In this environment, commodities are typically the best performing asset class," they state, adding that to be bullish on mining company performance, it is not necessary to believe that commodity prices will rise further, but that current spot prices will persist.

The graphs accompanying the report show that the share prices of Glencore and Anglo are at 2013 levels, despite Glencore's earnings being 45% higher and its net debt being 90% lower and Anglo's earnings being higher and its net debt 85% lower.

The analysts' finding is that mining companies on aggregate are trading at a discount to their historical average earnings and that this is especially so in the case of Glencore and Anglo.

They attribute this primarily to a lack of investor confidence in spot prices, stemming from a slightly softer China, but they point out that this softness is being offset by stronger 'rest of the world' growth and express the view that mining is at its strongest in many years, with mining companies generating double-digit free cash flow at spot prices.

Last month Glencore shot the lights out with a superlative set of 2017 results that coincided with a leap in its share price in Johannesburg, the reaffirmation of South Africa as an even more positive investment destination, and the mulling of a dividend "top up" later in the year.

The benefit of higher commodity prices and cost containment pushed up mining margins within the London-listed company's metals and energy operations, lifting operational cash flow to $11.6-billion and pulling down net debt to $10.7-billion.

"Mission accomplished as net debt hits lower end of target," was the comment of Bernstein analyst Paul Gait on the announcement, while Barclays analysts Ian Rossouw, Amos Fletcher and Kennedy Nyangoni headlined their commentary "top pick Glencore – beat and raise".

After presenting the company's strongest ever results, Glencore CEO Ivan Glasenberg remarked in response to analyst questioning that Cyril Ramaphosa coming in as President of South Africa boded well for the country, in spite of the resultant rand strength and impact on costs.

Glencore's positioning in 'tier 1' commodities and 'tier 1' assets is expected to continue to create value for all stakeholders, which could manifest itself in an augmentation of the dividend.

"Clearly, there's an opportunity, come interim results in August, to look at a top-up of the dividend distribution of 20c a share we've come up with," Glencore CFO Steven Kalmin said in response to analyst questions at the time.

In the latest, 'Sector set for rerating' note, the four Goldman Sachs analysts express positivity about mining equities against the backdrop of the world being in an expansionary phase and demand being above the capacity to supply.

They report that earnings are at a six-year high, balance sheets are very strong and unfettered cash is gushing – but that valuations are at a discount, and excessively so in the case of South Africa-linked shares, where the historical investor-induced equity price pull down on the basis of perceived political risk is no longer warranted.