Name of the Project

Songwe Hills rare earths project.

Location

South-eastern Malawi, between Lake Chilwa and the Mulanje Massif.

Project Owner/s

Mkango Resources.

Project Description

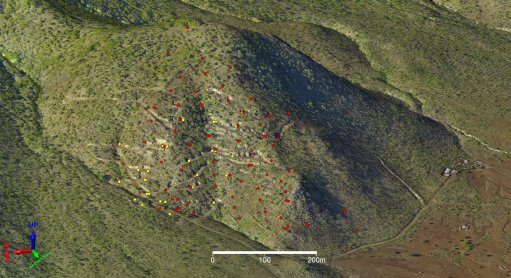

Songwe Hill was confirmed in July 2022 as one of the very few rare earths projects worldwide to have reached the definitive feasibility study (DFS).

The DFS envisages Songwe as a standalone project selling mixed rare-earth carbonates, as opposed to separated rare-earth oxides, and excluding Pulawy, which has potential to add significant downstream value.

The DFS envisages a conventional openpit contract mining operation, feeding mills, flotation and hydrometallurgy plants on site to produce a mixed rare-earth carbonate, with an operating life (mining and processing) of 18 years.

Mkango says there is potential to increase the mine life given the additional inferred resource, the potential to expand the mineral resource and the exploration potential of the nearby Nkalonje project. The mixed rare-earth carbonate is expected to be shipped to the proposed Pulawy rare earth separation project, in Poland, for separation. The processing capacity is about one-million tonnes a year of ore to produce an average of 5 954 t/y of total rare-earth oxides in mixed rare-earth carbonate for the first five years, and 4 081 t/y of total rare-earth oxides in mixed rare-earth carbonate from years 6 to 18.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value (NPV), at a 10% (nominal) discount rate, of $559-million and an internal rate of return 31.5% (nominal), with a payback of 2.5 years from full production. The NPV excludes any value attributable to the proposed Pulawy project, which is expected to process mixed rare-earth carbonate from Songwe Hill.

Capital Expenditure

Initial capital expenditure is estimated at $277-million, excluding a $34-million contingency, for the development of the mine, mill, flotation and hydrometallurgy plants, tailings storage facility and related project infrastructure in Malawi.

Planned Start/End Date

The DFS envisages mining starting in February 2025, with processing expected to ramp up from July 2025 and full production from September 2025.

Latest Developments

None stated.

Key Contracts and Suppliers

The MSA Group (geology, mineral resource and geotechnical investigation); Bara Consulting (mining); Grinding Solutions (comminution); DRA Global Company subsidiary SENET (process plant, including on- and off-site infrastructure); Australian Nuclear Science and Technology Organisation (hydrometallurgy); KYSPY Investments and ALS Metallurgy (flotation); Epoch Resources (tailings storage facility); Digby Wells and Associates and Kongiwe Environmental (environmental-, social- and health-impact assessment); SGS Australia (geochemistry); Western Geotechnical and Laboratory Services (geotechnical testwork); Steinweg Bridge (logistics).

Contact Details for Project Information

Mkango Resources, tel +1 403 444 5979.