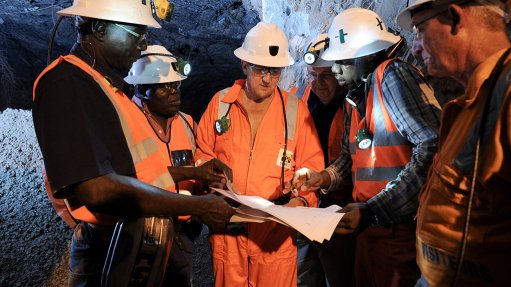

Randgold CEO Dr Mark Bristow (centre) with host country management at the Loulo gold mine

JOHANNESBURG (miningweekly.com) – Africa needs investments coupled with aggressive growth and if correctly managed, will be the world’s "next China", says Randgold Resources CEO Dr Mark Bristow, who has developed half a dozen highly successful gold mines on the continent besides traversing its length and breadth on his motorbike.

Speaking in Johannesburg on Monday, the founding head of what is arguably the world’s most successful gold discovering and developing company of the last two decades, said that with China off the boil and the world’s growth engine having moved to India and some of the Pacific Rim economies, Africa is poised to be the globe’s next economic focal point.

He urged developed countries that are no longer capable of delivering high-percentage growth in their own economies, to invest some of their money in Africa.

“If you look at 2025, I’m super excited about Africa, certainly sub-Saharan Africa,” Bristow said at a media meet attended by Mining Weekly Online.

The line from Dakar, in West Africa, to Dar es Salaam, in East Africa, is endowed with a proliferation of human resources, metals, forest and water, which reads power, he averred.

Investors would give themselves access to the planet’s youngest population that remained unconstrained by telephone lines.

Bristow views its modern population as having the best banking systems that allow money to pass around on cellphones in dynamic fashion.

What is needed to stimulate economic growth on the continent is investment in infrastructure.

On May 25, Bristow embarked on yet another motorbike ride across Africa, from Mombasa to the Congo river mouth, as part of an overall 15 000-km 48-day ride from Cape Town, through Swaziland, Mozambique, Malawi, Tanzania, Zanzibar, Kenya, Ethiopia and Sudan, and to Alexandria in Egypt.

He estimates that a billion-dollar investment will make a massive difference to many areas.

Bristow expects a political transition in the Democratic Republic of Congo (DRC), where Randgold has its large Kibali gold mine in partnership with South Africa’s AngloGold Ashanti, and sees it as similar to the situation unfolding in Zambia, which he describes as “just fixing itself” after being hurt as a result of drastic experimentation.

The government of Congo Brazzaville has just received a new mandate and he draws attention to progress under way in the Central African Republic.

Bristow finds that none of the people of the countries surrounding the DRC, which is very well endowed with natural resources, want any more wars in their backyards.

Randgold’s Tongon gold mine in the Ivory Coast, where more gold ounces are continually being added, is the company’s biggest cash cow.

He is full of praise for the Ivory Coast as an investment destination and is still exploring there intensively.

“Right now, if you were the Fairy Godmothers and I had one wish, it would be to find a plus-five-million-ounce mine in the Ivory Coast, because it’s just so easy to operate there,” Bristow told journalists.