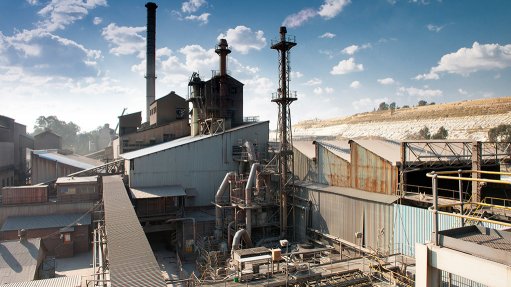

PRODUCT PRODUCTION Veremo aims to start first production at an existing smelter in Mogale in early 2015

Iron-developer Veremo Holdings aims to start production at its Mpumalanga-based Veremo pig iron, heavy minerals and titanium project in the third quarter of this year, director Alistair Ruiters tells Mining Weekly.

“Since the mining rights were issued in January, we’ve been conducting site preparation, assessing road construction and site establishment, negotiating access agreements, preparing a water licence application and finalising environmental studies,” he says.

The project, which has an estimated 30-year life-of-mine, is located on seven farms in the Steelpoort river valley, near Stofberg. The project will comprise three openpits that will extract iron-ore from five orebodies. The ore will be crushed and processed on site and the final product will be processed off-site.

“Our aim is to achieve a 40 000 t/m steady-state production,” says Ruiters, adding that the mine will initially produce 5 000 t/m, 10 000 t/m or 15 000 t/m and aims to ramp up production to 40 000 t/m in the first quarter of 2015.

The initial production target is about 400 000 t/y, he notes.

The project’s current deposits are estimated at 525-million tonnes of ore with an iron content of 43.2% and a titanium oxide content of 14.8%, while the current value of the Veremo project is estimated at $250-million, with an upside potential of about $600-million, according to mining consulting firm Venmyn Deloitte, which conducted an independent project valuation of Veremo.

Pig Iron Production

Having entered into an agreement earlier this year with Krugersdorp-based smelter Mogale Alloys – for use of its 12 MVA furnace – Veremo also aims to start first production at an existing smelter in Mogale in early 2015.

“Veremo aims to move from the laboratory phase to an almost full commercialisation stage in 2015, where we will test and smelt larger quantities of iron-ore,” highlights Ruiters.

The company has applied for environmental authorisation for a six-month testing, processing and smelting trial at the smelter and hopes to obtain approval by the end of the year. Veremo will produce about 8 000 t of pig iron during the test period, which will start in early 2015, to determine the feasibility of larger-quantity production.

Meanwhile, Veremo hired project management and engineering services firm GLPS to assist in modifying the furnace, which will enable Veremo to smelt iron-ore according to specific iron-ore smelting processes, says Ruiters. He adds that the furnace modifications should start this month.

Market Demand

Once Veremo is able to produce larger quantities of pig iron and titanium-enriched slag, the company will market the various raw and final products and will approach the market to quantify the demand and determine the amount of product needed to supply that demand, says Ruiters.

Veremo Holdings aims to supply iron-ore products to different markets, including China and India. The run-of-mine product will be supplied to China and the final, processed product would be consumed locally, in India and in China.

“As Veremo has invested significantly in understanding magnetite iron-ore processing in South Africa, we are committed to not only beneficiating as much of the product locally but also selling this beneficiated product locally, thereby maximising iron-ore value addition in South Africa,” adds Ruiters.

He points out that, while Veremo is consulting with several buyers for the Stofberg ore, the company still needs to find a way of transporting the ore from Stofberg to Richards Bay port.

Nevertheless, while the company intends to sell some of the ore to third parties, Ruiters acknowledges the current depressed iron-ore market.

He further notes that, as Veremo aims to produce an off-specification product and not a conventional iron-ore product, such as hematite with a 44%, 51% or 60% iron-ore content “the appetite in the market for the product is not as high, owing to the current low prices for pig iron”. He explains that the market is currently moving to more conventional iron-ore products, rather than off-specification products.

“Consequently, Veremo is currently in a difficult market position and we are trying to navigate all the difficulties,” says Ruiters.

Nevertheless, he highlights that, to date, its shareholders have supplied all funding for the project. He concludes that the project has not incurred any debt and that Veremo is currently in discussions with a possible investor for the project.