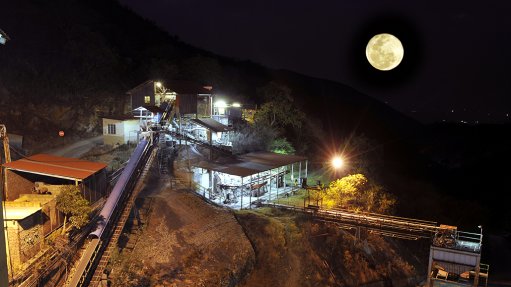

Pan African's Barberton mine

JSE- and Aim-listed gold miner Pan African Resources expects to report a 15% to 30% year-on-year decrease in headline earnings per share (HEPS) for the financial year ended June 30.

The company advises shareholders in a trading statement issued on September 1 that HEPS will likely be between $0.0295 and $0.0335, compared with HEPS of $0.0339 posted in the prior year.

Pan African cites the 16.8% depreciation in the average rand:dollar exchange rate in the year as the main reason for its earnings decline.

The average rand:dollar exchange rate was R17.77/$1 for the year under review, compared with an average exchange rate of R15.22/$1 in the prior year.

The closing exchange rate as at June 30 was R18.83 to the dollar.

Pan African highlights the average and closing exchange rates, which were 16.8% and 15.7% higher, respectively, year-on-year, should be considered when comparing the two latest financial years.

The company’s gross profit, in rand terms, will only decrease by about 3.2% compared with the prior year.

Pan African owns and operates the Barberton Underground, Barberton Tailings Retreatment, Evander Underground and Elikhulu Tailings Retreatment projects in South Africa.