Photo by: Blencowe Resources

Name of the Project

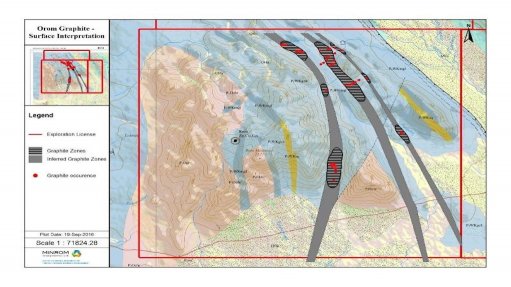

Orom-Cross graphite project.

Location

Uganda.

Project Owner/s

Blencowe Resources.

Project Description

A prefeasibility study (PFS) has highlighted an exceptional long-life project that delivers considerable returns over an initial life-of-mine of 14 years. An estimated 600 000 t/y of ore will be mined from the commissioning date and this will increase to 2.4-million tonnes a year by the time the project is fully ramped up in Year 10.

Mining will be free-dig, with no drill-and-blast required. Initial ore will come from saprolite (clay) at about 15 m to 20 m depth on average. Both deposits (Northern syncline and Camp lode) identified in the drilling programmes will be mined and a composite blend of both will be fed into the processing plant that will be built on site.

An initial 36 000 t/y of end-product as concentrates will be delivered from the plant, which will increase in two additional stages to 147 000 t/y once the mine is fully ramped up.

Further resources, higher production volumes and an extended mine life can all be obtained at any stage by drilling additional ready-targets. This, however, is not currently considered a priority.

The processing flowsheet comprises a flash and rougher flotation stage, followed by a primary cleaning circuit with a polishing mill and three stages of cleaner flotation. The intermediate concentrate is classified and then further upgraded in secondary cleaning circuits with stirred media mills, followed by cleaner flotation.

Orom-Cross will deliver at least five different end-products, characterised by different mesh size fractions of +50 mesh, + 80 mesh, +100 mesh, +150 mesh and -100 mesh. These products will all have different markets and will be branded and packaged at site.

Initially, transport to port will be by road, but it is expected that a rail option might be available nearby by 2025, further reducing logistics costs.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a after-tax net present value, at an 8% discount rate, of $482-million and an internal rate of return of 50%.

Capital Expenditure

The initial capital requirement has been lowered by 23% to $62-million, since the preliminary economic assessment was announced in 2021.

Planned Start/End Date

Blencowe will start the main operations from 2025 at an initial output of 36 000 t/y of end-product.

Latest Developments

Blencowe is advancing towards initial-stage production at Orom-Cross by the second half of 2023.

Key Contracts, Suppliers and Consultants

Battery Limits (PFS).

Contact Details for Project Information

Blencowe Resources, tel +44 1624 681 250 or email info@blencoweresourcesplc.com.