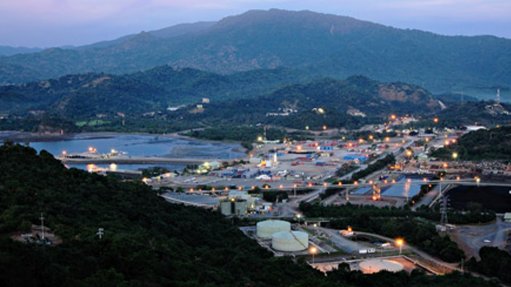

TORONTO (miningweekly.com) – US gold major Newmont Mining has agreed to sell its stake in the Batu Hijau copper/gold mine in Indonesia, citing its strategic priorities to lower debt and fund its highest-margin projects.

The Denver, Colorado-based miner has agreed to sell its 48.5% stake in PT Newmont Nusa Tenggara (PTNNT) for $1.3-billion to PT Amman Mineral Internasional (PT AMI). According to Newmont, Nusa Tenggara Mining Corporation, which is majority-owned by Sumitomo Corporation, had also agreed to sell its ownership stake to PT AMI.

Newmont advised that payment would comprise $920-million in cash and contingent payments of $403-million tied to metal price upside and development of the Elang gold project.

Pending regulatory approval and satisfying other conditions precedent, the transaction was expected to close in the third quarter. These conditions included government approval of the PTNNT share transfer; a valid export licence at closing; concurrent closing of PT Multi Daerah Bersaing’s sale of its 24% stake to the buyers; resolving certain tax matters; and no material adverse events that would substantially impact the future value of Batu Hijau.

Newmont pointed out that it had strengthened its portfolio and balance sheet over the last three years, raising $1.9-billion in proceeds from selling noncore assets and lowering net debt by 37% since 2013, despite investing in profitable growth.

Newmont had recently acquired the Cripple Creek & Victor gold mine, in Colorado, and added five-million ounces of gold reserves through exploration campaigns in 2015. The company was also advancing four development projects in the US, Australia and Suriname, which were expected to add up to one-million ounces of profitable production over the next two years.