EXPLORATION IMMINENT Horomela was granted the prospecting rights for about 150 000 ha in the Northern Cape and noninvasive prospecting of the properties will start this month

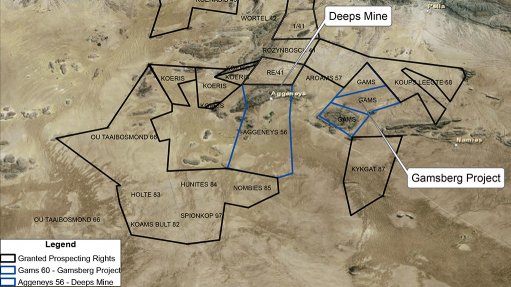

Base metals explorer and mining aspirant Horomela Investments received prospecting rights for all 14 of its zinc, copper, silver and lead properties in the Namaqualand region of the Northern Cape last month.

Horomela CEO Abongile Mdingi tells Mining Weekly that these properties collectively cover about 150 000 ha.

He says Horomela’s in-house team of geologists will start noninvasive prospecting this month and will include the geophysical, geochemical and aeromagnetic testing of the sites.

“Once this has been completed and the most commercially lucrative sections have been identified, a complex will be built around the about 7 500 ha Koeris 54 property,” Mdingi states.

The company was granted prospecting rights for Koeris 54 in May 2015, with initial noninvasive prospecting indicating significant zinc sulphates occurrences.

Mdingi says the noninvasive prospecting campaign for the other properties is expected to take between 8 and 12 months to complete.

He points out that the geologist prospecting on Koeris 54 noticed that the nearby Hoogoor 37 property had zinc sulphates on the surface, which indicate that there are “good, minable” zinc resources at the site.

Mdingi also highlights that Horomela’s properties are located along high-quality zinc deposit zones and are adjacent to LSE-listed diversified miner Vedanta Resources’ Black Mountain and Gamsberg zinc projects.

Mdingi states that the company intends to not only develop these properties but also operate the mines once they are in production. “Horomela, as the only 100% black-owned and -managed base metals mining company in South Africa, wants to be an example for other emerging black industrialists, particularly in the mining industry.”

The company also aims to partner with other companies and institutions in the private and public sectors to finance the development of its project sites, he adds.

However, Mdingi stresses that the company will seek to retain a significant shareholding that is more than the legislated 26% historically disadvantaged South Africans (HDSAs) share that is required by the Mining Charter.

“We intend to retain enough control to ensure that Horomela has a meaningful say in the development and running of these projects. This will ensure that the projects are truly a vehicle for black economic empowerment and local job creation in the region.”

He emphasises the company’s aim to create job opportunities for the locals of the town of Aggeneys, which will be achieved through having operating mines in the area in the next five years to ten years, as their development could provide as many as 500 people, mostly locals, with full-time employment. Ensuring skills transfer will enable people to further improve their job prospects.

Moreover, Mdingi contends that Horomela wants to become a leader for other HDSAs who have ambitions of creating generational wealth and who intend to get involved in the local mining industry. Therefore, it is “highly significant” that the company already owns mining assets, as this has been a challenge for other aspirant HDSAs, as many of them were not able to raise the initial finance to secure properties to develop mines.

Mdingi is particularly upbeat about the prospects of the company’s properties, owing to their potentially significant zinc and lead deposits. He says these commodities continue to rise in value, owing to a shortage in supply and the growing demand for zinc in the steel and agriculture sectors.

Many of the zinc and lead mines that currently supply the market are rapidly being depleted, with many others having closed down over the past five years, he adds.

Many analysts’ positive outlook for zinc and lead prospects over the next five to ten years “ . . . will ensure that investors remain interested [in such] . . . projects for the foreseeable future”, Mdingi concludes.