Name of the Project

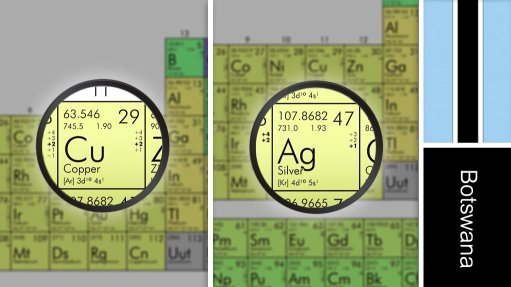

Khoemacau copper/silver project.

Location

North-west Botswana.

Project Owner/s

Khoemacau Copper Mining (KCM), a subsidiary of Cupric Canyon Capital.

Project Description

The project entails the construction of KCM’s 3.6-million-tonne-a-year starter project, processing ore from the 91-million-tonne resource at a head grade of 2.02% copper and 21.4 g/t silver copper.

The company plans to develop the Zone 5 orebody as three separate underground mines, each producing 1.2-million tonnes a year on average for the first five years.

Each of the mines will have its own independent ramp access and operate over a strike length of about 1 000 m, extracting ore using a conventional sublevel open-stoping mining method.

The mined ore will be trucked 35 km to the Boseto processing facility, which will be refurbished and enhanced to process 3.65-million tonnes a year. Processing will be conventional sulphide flotation using three-stage crushing, ball milling and flotation, which will produce a high-quality copper concentrate grading at about 40% for shipment to African and international smelters.

The underground mine will be fully mechanised.

Initial production is estimated at an average of 62 000 t/y of copper and 1.9-million ounces of silver.

In addition to Zone 5 resources, there are a further 93.5-million tonnes of high-grade ore grading 1.9% copper and 33 g/t silver across the Khoemacau project. KCM plans to develop these resources in conjunction with the construction of the starter project.

The long-term plan is to expand Khoemacau to about 5.8-million tonnes a year through the expansion project, whereby a new standalone process plant will be built at Zone 5. The project is expected to produce more than 100 000 t/y of copper.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

The direct construction cost of the starter project is $397-million.

Planned Start /End Date

First copper concentrate is expected to be produced in the first half of 2021.

Latest Developments

Fluor Corporation has been awarded an engineering, procurement and construction management (EPCM) contract for the Khoemacau project.

The contract will include upgrading the existing copper concentrator plant and new mine surface infrastructure.

Key Contracts and Suppliers

Fluor Group (engineering, procurement and construction management contract) and Ausdrill subsidiary Barminco (underground mining services contract).

On Budget and on Time?

Not stated.

Contact Details for Project Information

Cupric Canyon Capital, tel +1 480 607 6771 or email ccc@cupriccanyon.com.