Photo by: Sovereign Metals

Name of the Project

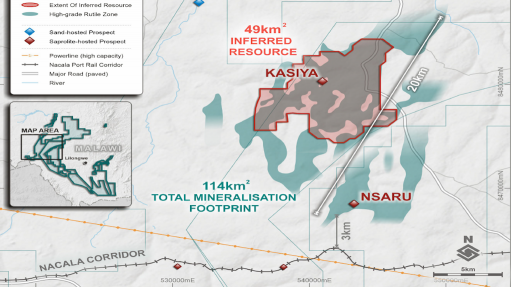

Kasiya rutile project.

Location

Malawi.

Project Owner/s

Sovereign Metals.

Project Description

Kasiya is the biggest undeveloped rutile deposit in the world and one of the world’s biggest flake graphite deposits.

Sovereign’s expanded scoping study for Kasiya, released in June 2022, is based on the updated mineral resource estimate, reported in April 2022, of 1.8-billion tonnes containing 18-million tonnes of rutile at 1.01% and 23.4-million tonnes of graphite at 1.32%.

The study envisages a 25-year mine life during which time rutile and graphite are produced during two stages.

Stage 1 (years 0 to 5) comprises the processing of 12-million tonnes of ore a year to produce about 145 000 t /y of natural rutile and 85 000 t/y of flake graphite.

Stage 2 (years five to 25) will add 12-million tonnes of capacity for a total of 24-million tonnes a year of ore processed to produce about 260 000 t/y of rutile and 170 000 t/y of flake graphite.

Net Present Value/Internal Rate of Return

The expanded scoping study shows an after-tax net present value, at an 8% discount rate, of $1.54-billion and an internal rate of return of 36%, with payback from the start of construction of 2.6 years.

Capital Expenditure

Stage 1 capital costs to first production are estimated at $372-million, while those for Stage 2 is estimated at $311-million, funded from project cash flows.

Planned Start/End Date

Not stated.

Latest Developments

Sovereign Metals has struck a nonbinding memorandum of understanding (MoU) with Japanese trader Mitsui & Co to establish a marketing alliance and offtake for 30 000 t/y of natural rutile from the Kasiya rutile project.

The alliance will enable Sovereign to leverage off Mitsui’s extensive network and its market-leading understanding of the titanium industry and global logistics.

Mitsui has shared samples of rutile product from Kasiya with Asian end-users that have confirmed its premium chemical specifications should be suitable for use in their titanium sponge and pigment processes as a precursor for high-grade, high-specification titanium metal and pigment production.

The MoU is nonexclusive and nonbinding with no pricing terms, which remains subject to negotiation and execution of a definitive agreement. The MoU will expire at the end of December 2023, but can be extended through an agreement by both parties, should a definitive agreement not have been reached by that time.

An expanded scoping study into the Kasiya project recently confirmed that the project would require a capital investment of $372-million to first production, and could generate life-of-mine revenues of more than $12-billion, based on the production of 265 000 t/y of rutile and 170 000 t/y of graphite and a mine life of 25 years.

Key Contracts, Suppliers and Consultants

DRA (lead study manager); Jem-Met (project management); Placer Consulting (mineral resource estimate); Oreology Mine Consulting (mine scheduling and pit optimisation); Fraser Alexander (mining methods and tailings management); Epoch Resources (tailing disposal); AML (metallurgy – rutile); SGS (metallurgy – graphite); Dhamana Consulting (environment and social studies); JCM Power (power); TZMI (marketing – rutile); Fastmarkets (marketing – graphite); Morgan Sterling Consultants (logistics); and Minviro (life-cycle assessments).

Contact Details for Project Information

Sovereign Metals, tel +61 8 9322 6322 or email info@sovereignmetals.com.au.