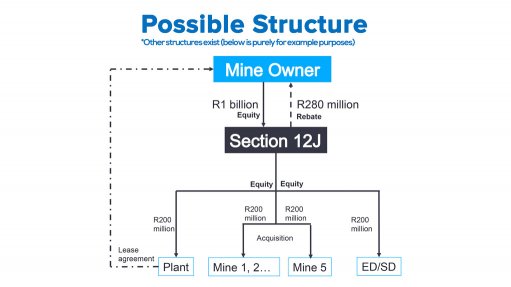

Possible structure for Section 12J tax incentive

Photo by: Jaltech

JOHANNESBURG (miningweekly.com) – Interest is building in the Section 12J of the Income Tax Act incentive structure introduced by Treasury to promote venture capital investments and stimulate growth and job creation in the South African economy, Mining Weekly Online can report.

The aim of Section 12J is to encourage investment into qualifying investments, with qualifying investors in turn receiving a tax deduction for the investment.

More than 70 Section 12Js have been registered and Jaltech director Jonty Sacks describes the provision as having now found its feet.

It has an attractive structure for mine owners looking to expand operations or to acquire new plant and mines.

The structure makes use of incentives allowing companies and individuals to receive a tax deduction of up to 28% to 45% on their investments.

In addition, the structure can be formed so that investments into the Section 12J venture capital company attract enterprise development or sustainable development points, where the underlying investments qualify.

The full amount invested in the venture capital company is 100% deductible from an investor’s taxable income in the year in which the investment is made and applies to any South African taxpayer.

Funds invested are zero rated for capital gains purposes and Mining Weekly Online can report that the effect on a R10-million investment offers tax relief of R2.8-million in the tax year of initial investment, a relief of 28%.

All mining companies need to do is to identify the investments and carry on operating as usual and companies like Jaltech see to developing the most efficient structures within the required legislation and manage processes and controls.

Earlier this year, Jaltech established the JSS Empowerment Mining Fund, a new empowerment fund aimed at filling a junior-mining niche funding gap, in partnership with construction, mining and processing group Stefanutti Stocks.

It has since discovered significant application for mining companies in general, big and small, to access the tax incentive to stimulate the market.

It sees many angles of benefit for mining majors, mining investors and traders. All of these entities have access to Section 12J to increase internal rates of return, said Sacks.

Typically, mining companies can either invest into junior miners doing exploration, or mining operations, and effectively acquire an interest in a junior miner at a 28% discount, assuming they have taxable profits that they can offset.