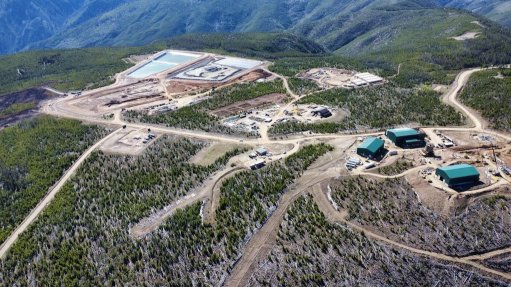

Photo by: Jervois Global

Name of the Project

Idaho Cobalt Operations (ICO).

Location

Idaho, in the US.

Project Owner/s

Jervois Global.

Project Description

The project was partially constructed when Jervois acquired it in July 2019, with more than $120-million invested by the previous owners since the discovery of the cobalt deposit.

An updated bankable feasibility study (BFS) has confirmed the potential of ICO to establish a near-term, low-cost cobalt/copper/cobalt mine, with significant opportunity to increase the mineral resource and extend mine reserves once mining starts.

The BFS is based on extracting 2.5-million metric tons of ore at an average grade of 0.55% cobalt, 0.80% copper and 0.64 g/t gold. Based on a processing rate of 1 200 t/d, the project could produce 1 915 t/y of cobalt, 2 900 t/y of copper and 6 700 oz/y of gold in concentrate over a seven-year life-of-mine.

The operation will comprise a 1 200 t/d mill and concentrator to produce separated cobalt and copper concentrates.

Gold mineralisation in the reserve at ICO will be recovered at the São Miguel Paulista refinery, in Brazil, subject to Jervois’ completing the acquisition and restart of the refinery in stages during 2022 and 2023.

Jervois has also completed engineering design and costing, flowsheets to produce separate cobalt and copper concentrates, and calcined cobalt concentrate as part of the BFS.

Potential Job Creation

The project is expected to create about 200 construction jobs and 180 operational positions once the site transitions to commercial production.

Net Present Value/Internal Rate of Return

The project has a real post-tax net present value, at an 8% discount rate, of $95.7-million and an internal rate of return of 40.6%.

Capital Expenditure

$107.5-million.

Planned Start/End Date

In January 2023, Jervois announced that first commercial concentrate production was now expected at the end of the first quarter 2023 and that it expected to ramp up to full nameplate capacity in the second quarter of 2023.

Latest Developments

Jervois has suspended construction at ICO, owing to falling cobalt prices and inflationary impacts on construction costs in the US.

The company has said that cobalt prices are expected to recover in the medium term from influences of the energy transition and Western cobalt purchasers’ increasing preferential to buy from sources with Western environmental and social governance credentials, and that Jervois will complete the construction and commissioning of ICO when cobalt prices have recovered.

Jervois will immediately start an orderly and rapid demobilisation of construction contractors from ICO’s site, which is expected to be completed in the coming weeks.

Total workforce, including contractors, will reduce from about 280 to under 30, which represents a fit-for-purpose workforce to maintain the site in compliance with its regulatory requirements.

The company has told shareholders that not mining ICO cobalt at cyclically low prices will preserve the optionality and inherent strategic value of ICO for shareholders and key stakeholders.

The company has applied for funding from the US Department of Defence (DoD) to accelerate drilling to increase the mineral resource and reserves at ICO, and to assess the construction of a US cobalt refinery, which will both proceed despite the suspension of construction at ICO.

The DoD has advised that it will award Jervois $15-million in funding through a Not to Exceed Technology Investment Agreement, subject to Jervois successfully completing the required documentary steps.

Jervois is also engaging with the US Department of Energy and export credit agency EXIM on further financing initiatives.

Key Contracts, Suppliers and Consultants

DRA Global and M3 Engineering (BFS).

Contact Details for Project Information

Jervois Global, tel +61 (03) 9583 0498 or email contact@jervoisglobal.com.