ASX-listed Horizon Minerals and Greenstone Resources on Tuesday announced a merger to create a new emerging gold producer in the Western Australia goldfields.

Under the scheme of arrangement, Horizon will acquire 100% of the fully paid ordinary shares in Greenstone and 100% of the listed Greenstone options in exchange for shares.

Based on the last trading price of the companies, the exchange ratio represents an 89% premium to Greenstone’s last traded price on February 9 of A$0.0055 a share, and a 40% premium to the 30-day volume weighted average price of A$0.0074 a share for the period up to February 9.

Upon completion in June this year, Horizon shareholders will own 63.1% of the merged entity, while Greenstone shareholders will own the remaining 36.9%. The company will continue to trade as Horizon Minerals.

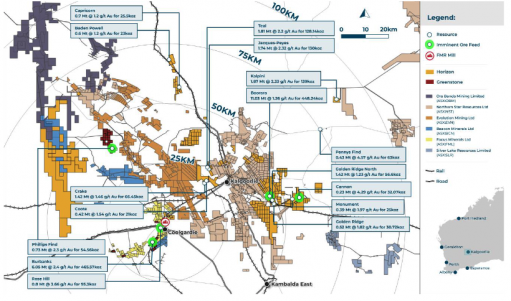

The combined group will have a Joint Ore Reserve Committee-compliant mineral resource of 1.8-million ounces, as well as an exploration holding, all of which are centred around the gold mining hubs of Kalgoorlie and Coolgardie.

“This really is a logical consolidation of complementary assets which creates greater potential for Horizon to unlock the value within our longer project pipeline. Following a period where we divested non-core assets and brought greater focus onto a pipeline of smaller, near-term cash-generating mining opportunities, this merger with Greenstone will both add to this near-term pipeline and bring greater scale to our baseload assets with the addition of the high-grade Burbanks deposit,” said CEO Grant Haywood.

Greenstone MD and CEO Chris Hansen added that the merged entity, which has an ambition to become the next midtier gold producer, would be in a “much stronger position” to deliver for both sets of shareholders.