SINGAPORE – Gold producers in Australia are outperforming their global competitors, prompting investors to encourage them to expand their horizons and acquire struggling North American rivals.

Boosted by some of the sector’s best margins, low debt and swelling cash piles, miners in the world’s No. 2 producer are defying a wider lull in gold equities. Saracen Mineral Holdings and Northern Star Resources have surged in the past year as rivals in Canada, the US and South Africa faltered.

“Australian gold miners currently enjoy some of the highest margins in the world,” said Stephen Land, San Mateo, California-based portfolio manager at the $1.1-billion Franklin Gold and Precious Metals Fund. The producers are being supported by cuts to operating costs and stronger prices of bullion in Australian dollar terms.

Miners in Australia and New Zealand account for about 20% of the Franklin fund’s holdings, which last year added positions in Dacian Gold and Gascoyne Resources. Australian companies are now valued more equitably against North American peers “allowing them to be competitive in global M&A,” Land said.

Newcrest Mining, Australia’s top producer, invested $250-million in Canada’s Lundin Gold this year, while St. Barbara is examining potential deals that could include the US. Evolution Mining and Northern Star are among other companies with the firepower to move on poorly performing North American miners in the short-to-medium term, Argonaut Securities said in a note last month.

“We will consider adding overseas assets to our Australian portfolio,” Evolution’s executive chairman Jake Klein said in an emailed statement. The producer has a “preference for first world jurisdictions and hence North America is on the radar.” Northern Star didn’t immediately respond to a request for comment.

Valuations of Australian producers are on par with North American companies for “the first time in memory,” according to Joe Foster, New York-based portfolio manager for the $675-million VanEck International Investors Gold Fund. Australian and US producers currently trade on a similar price-to-cash flow ratio, a metric favored by investors to compare companies in the same industry.

“Australia is a mature gold jurisdiction and companies will have to go abroad for opportunities,” Foster said. “‘If Australian investors won’t support international M&A, then the companies will have to look for support from investors abroad.”

Newcrest and Evolution are among the miners scheduled to address the three-day Diggers and Dealers forum starting Monday in Kalgoorlie, Western Australia. About 50 companies, including BHP Billiton, Fortescue Metals Group and other producers of gold, base metals and battery raw materials will make presentations to more than 2,100 delegates.

Smaller producers including Dacian Gold, Gascoyne and Red 5 all have room to grow with “interesting opportunities to deploy cash” on exploration, according to Franklin Templeton’s Land, whose fund holds all three companies. VanEck’s list of junior companies with potential includes West African Resources, Cardinal Resources and Gold Road Resources, Foster said.

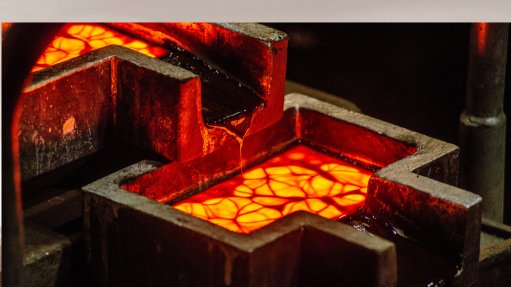

“The North American investors like what they see,” said Rohan Williams, executive chairman and CEO of Perth-based Dacian, which poured a first gold bar in March at the Mount Morgans mine in Western Australia. Miners in the nation are winning attention by “aggressively exploring and finding more gold,” he said. Dacian raised almost A$50-million ($37 million) in share sales last month.

Australia’s gold producers can continue to outperform competitors -- and woo global investors -- by using strong cash flows to fund exploration at medium-sized mines that have historically lacked detailed studies, Melbourne-based RBC Capital Markets analyst Paul Hissey said in a note last month.