GOLD STRUCK Lubando's evaluation demonstrated an increased mineral resource tonnage of 160% with gold content increasing by more than 42%

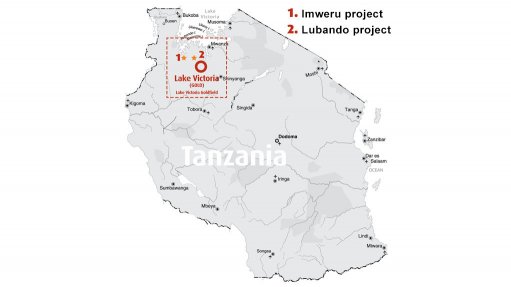

London investment company Opera Investments’ decision to acquire the Lubando and Imweru assets, in Tanzania, has been reaffirmed by an evaluation by South African consulting group Minxcon, which confirmed Lubando’s gold resource at 6.78-million tonnes, grading 1.10 g/t and containing 293 870 oz.

Minxcon completed the evalu- ation of the Lubando gold project’s geological assets – which are currently owned by Tanzania-focused miner Kibo Mining – in February.

Minxcon’s evaluation of Imweru, also completed in February, showed that it hosted 2.36-million tons of indicated resource, at 1.19 g/t and 90 800 oz, while its inferred resource measured 9.24-million tonnes, at 1.43 g/t and 424 310 oz, for a total resource of 515 110 oz.

Kibo and Opera, in September, signed a heads of agreement for the unloading of Kibo’s wholly owned UK subsidiary, Sloane Developments, for 61-million Opera shares of 1p issued at a price of 6p apiece to satisfy the acquisition of the Imweru and Lubando gold projects.

In a March press release, Kibo stated that the proposed acquisition was nearing completion.

Minxcon’s website provides insight into its evaluation process, noting that it conducted a reinterpretation of the digital wireframe model based on existing data, using a 0.2 g/t shell cutoff grade. Additionally, it completed an updated mineral resource estimate to produce a Joint Ore Reserves Committee-compliant competent person’s report.

The company used geophysical interpretations and historical interpretations compiled by the Lubando project geologists to generate the resource wireframes and the interpretation of crosscutting faults to generate a properly faulted model. It conducted statistics, geostatistics and variography to generate what is known as a Kriging mineral resource estimate.

Minxcon

adds that, at Lubando, a mineral resource depth cutoff of 200 m was applied to the mineral resources to calculate the openpittable mineral resources, while the balance, at a depth greater than 200 m, was declared as the underground mineral resource at a higher cutoff grade. These parameters were based on economic calculations and pit optimisations.

Overall, the updated geological model and estimation methodology increased the mineral resource tonnage by some 160% and the gold content by more than 42%, adding significant value to Opera’s intended asset.