COAL RAILWAY SYSTEM Export coal performance has shown an upwards trend, with rail export volumes of coal increasing from 62.6-million tons in the 2010/11 financial year to 76-million tons in the 2014/15 financial year

The sharp decline in coal prices since 2011 has resulted in several mines becoming only marginally profitable, says State-owned logistics company Transnet group commercial GM Divyesh Kalan.

The price of thermal coal was about R140/t in January 2011, compared with $62/t at the end of January this year.

Kalan says the consequence of this decline is that many coal producers are requesting that Transnet reduce its coal transport tariffs.

He points out that mines’ approach to Transnet’s tariff structure is based on the assumption that margins are such that they can be adjusted downwards to ensure that Transnet “can bail out mines” when required.

A business model that can be adapted to fluctuations in the business environment and adjusted to commodity prices does not currently exist, however, Kalan highlights, adding that the fact that there are more coal trains available to transport the product than there is coal presents another challenge.

Additionally, he notes that there are suggestions by government that it might restrict the amount of coal exports, owing to State-owned power producer Eskom’s supply shortages. This could potentially impact on coal export volumes and Transnet’s future export-infrastructure upgrade programmes.

“The long-term infrastructure programme of Transnet spans on average 20 to 40 years, but, when we sign up a ten-year ‘take or pay’ contract with mines, we cannot recover the life of assets over this short period . . . the tariff would be very high and unaffordable to the industry,” Kalan explains.

Therefore, he states, Transnet has taken “huge risks” by spending billions on infrastructure development and has subsequently been saddled with potential redundant future capacity.

Hence, he says, mining companies that export bulk materials must work with Transnet to ensure a win-win situation for both parties.

Kalan points out that, despite the challenges in the coal sector over the past five years, export coal performance has shown an upwards trend, with rail export volumes of coal increasing from 62.6- million tons in the 2010/11 financial year to 76-million tons in the 2014/15 financial year.

Although Transnet is on course to achieve its target of railing 77-million tons of export coal during the current financial year, it could even exceed it significantly, he adds.

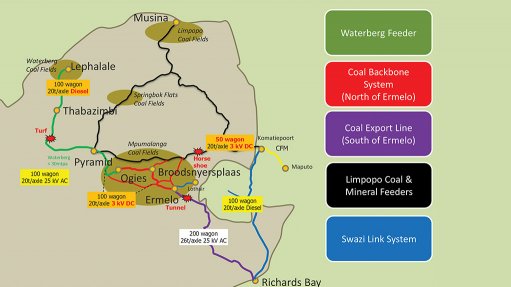

Transnet’s R45.5-billion coal line export-channel expansion programme is aimed at expanding the parastatal’s coal export channel, which links the coalfields of Mpumalanga and those of the Waterberg, in Limpopo, to markets in Europe and Asia. This will be achieved by increasing capacity on the corridor to 81-million tons a year over the next two year and thereafter to 97.5-million tons a year over the next seven years.

Creamer Media’s Research Channel Africa reported in February that the programme combined investments in new infrastructure and rolling stock, most notably a comprehensive dual-voltage locomotive acquisition programme.

The current infrastructure construction programme for the expansion of the coal export transportation network to 81-million tons includes various sustaining investments and the upgrade of four yards at Blackhill, Saaiwater, Ermelo and Vryheid, as well as 11 substations, five new substations and two locomotive workshop upgrades, with a new locomotive turntable at Richards Bay, in KwaZulu-Natal.

The work packages are being executed using in-house resources and external design and supply contracts.

Transnet has also brought forward the engineering and design work on the Overvaal second tunnel, owing to the operational challenges and risk associated with this single-line tunnel between Ermelo, in Mpumalanga, and Richards Bay.

Juniors’ Jitters

Kalan also notes that the privately owned Richards Bay Coal Terminal is South Africa’s main coal export port and allows junior miners to export only RB1-grade coal.

“This in itself is a major constraint for many junior miners, as Asian countries, such as India and China, are increasingly requesting RB3 grades.”

Further, he points out that the stockpile constraints at the ports do not allow junior miners to be in charge of their own commercial arrangements.

“Therefore, in many cases, they have to sell their product to traders or brokers to ensure their product gets to market. This additional cost negatively impacts on junior miners’ commercial viability,” he emphasises.

Kalan was a speaker at black-owned training and conferencing company Intelligence Transfer Centre’s second yearly Coal Transportation Africa summit, held in Johannesburg last month.