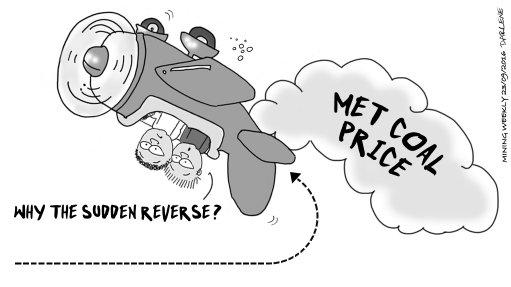

ANZ Research senior commodities strategist Daniel Hynes says that, when the price of a commodity rises by 117% in a mere 15 weeks, as the price of metallurgical coal did, it is generally a sign of something being amiss. What happened was Chinese coking coal output fell and that, plus a tight seaborne market, rode smack bang into fever pitch Chinese buying. Those factors caused the prices of premium hard coking coal to soar to $200/t, a price not seen since a third of world supply was taken out by the 2011–2012 flooding in Queensland, Australia. However, at the time of going to press, the price altitude was already abating as China’s coal miners sought official approval to boost output and coking coal producers in Mongolia, Canada and the US eyed the rise and ramped up output.