Photo by: Prospect Resources

Name of the Project

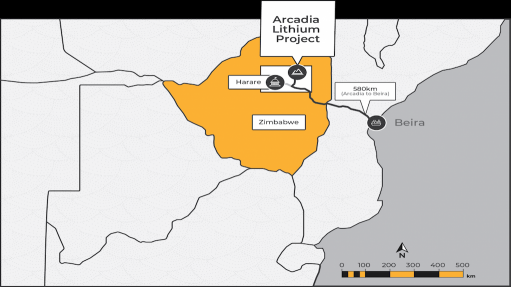

Arcadia lithium project.

Location

Zimbabwe.

Project Owner/s

Zhejiang Huayou Cobalt acquired the Arcadia hard rock deposit from Australia-listed Prospect Resources for $422-million in April 2022. The Chinese company invested a further $300-million to build a plant to produce 450 000 t/y of lithium concentrates.

Project Description

A direct optimised feasibility study (OFS) has shown the strong potential of Arcadia to become a compelling long-life, large-scale, hard-rock openpit lithium mine.

The direct OFS envisages a development pathway that entails the construction of a 2.4-million-tonne-a-year nameplate capacity plant in a single stage, unlike the staged OFS that considered the construction of two 1.2-million-tonne-a-year modules.

Average production in concentrate has increased from 133 000 t/y of spodumene in the staged OFS to 147 000 t/y in the direct OFS, technical petalite from 86 000 t/y to 94 000 t/y and chemical petalite from 22 000 t/y to 24 000 t/y.

The Arcadia deposit will be mined as a conventional truck-and-shovel openpit operation using contract mining. Waste dumps are to be located as close as possible to pit exit points to minimise haulage profiles without disrupting the access to the mineable resource or crushing plant.

The mine life has decreased from 20 years in the staged OFS to 18.3 years in the direct OFS.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project had a pretax net present value (NPV), at a 10% discount rate, of $465-million in the staged OFS and an internal rate of return (IRR) of 35%, with a payback of 5.4 years from the final investment decision.

In the direct OFS the project has an NPV, at a 10% discount rate, of $1.02-billion and an IRR of 61%, with a payback of 3.33 years from the final investment decision.

Capital Expenditure

The direct OFS estimates preproduction capital expenditure at $192.46-million.

The staged OFS required a total capital investment of $212-million – $140-million for Stage 1 and $72-million for Stage 2.

Planned Start/End Date

Not stated.

Latest Developments

Zhejiang Huayou Cobalt has commissioned the Arcadia concentrator.

The Arcadia plant took nine months to build and started exporting concentrates in April 2023 after the plant went into trial production, Huayou VP and chairman of the Zimbabwe unit, George Fang said in a speech to mark the commissioning.

"We have exported close to 30 000 metric tons. This equates to $40-million in revenue generation," Fang said.

Huayou's Zimbabwe unit deputy GM Trevor Barnard has said that the company is undertaking feasibility studies on further processing.

“We are not at the battery stage yet, it will take a regional approach from quite a few mines coming together to do beneficiation (processing),” Barnard told Reuters.

Key Contracts, Suppliers and Consultants

Lycopodium (direct DFS).

Contact Details for Project Information

Zhejiang Huayou Cobalt, tel +86 573 88589981.