Photo by: Horizonte Minerals

Name of the Project

Araguaia ferronickel project.

Location

Pará state, Brazil.

Project Owner/s

Horizonte Minerals.

Project Description

A feasibility study has confirmed Araguaia as a Tier 1 project with a large, high-grade scalable resource, long mine life and low-cost source of ferronickel for the stainless steel industry.

The project has two principal mining centres – Araguaia nickel south (ANS) and Araguaia nickel north (ANN). ANS hosts the Pequizeiro, Baiao, Pequizeiro West, Jacutinga, Vila Oito East, Vila Oito West and Vila Oito deposits, while ANN hosts the Vale do Sonhos deposit.

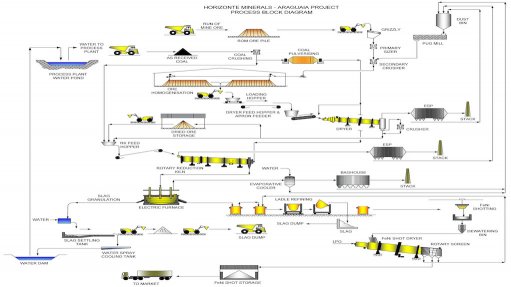

The feasibility study comprises an openpit nickel laterite mining operation that delivers ore from several pits to a central rotary kiln electric furnace (RKEF) metallurgical processing facility.

The metallurgical process comprises a single line RKEF to extract ferronickel from the ore. After an initial ramp-up period, the plant will reach full capacity of about 900 000 t/y of dry ore feed to produce 52 000 t of ferronickel, which in turn, will contain 14 500 t/y of nickel over a 28-year life-of-mine. The ferronickel product will be transported by road to the Port of Vila do Conde in the north of the state for sale to overseas customers.

Included in the study is the option for future construction of a second process line, which would double Araguaia’s production capacity from 14 500 t/y of nickel up to 29 000 t/y of nickel.

The Stage 2 expansion gives a 26-year mine life.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The Stage 2 expansion generates an estimated net present value of $741-million and an internal rate of return of 23.8%.

Capital Expenditure

The project has an initial capital cost of $443-million.

Planned Start/End Date

The project remains on track to deliver its first nickel in the first quarter of 2024.

Latest Developments

Horizonte Minerals has entered into long-term power purchase agreements (PPAs) with a subsidiary of a global AAA-rated energy company and Brazilian energy firm Casa dos Ventos Comercializadora de Energia, thereby securing renewable power at a low cost for its Araguaia nickel project.

The PPAs comprise three underlying contracts, with all suppliers using renewable power and delivering a fixed price of $28.4/MWh during the first five years and $29.6/MWh for the next five years, excluding transmission costs and other charges.

This favourable pricing represents an estimated cost of about $1 400/t nickel, when transmission costs and charges are included, compared with about $2 000/t nickel used as the basis for the feasibility study.

The PPAs will supply 100% of the expected power demand during the ramp-up period and the first five years of operations, in addition to more than 60% of the expected power demand for the following five years.

Key Contracts, Suppliers and Consultants

Ausenco Engineering Canada (process plant design); FLSmidth, Metso Outotec, Uvån Hagfors Teknologi Inteco Melting and Casting Technologies (equipment supply and technical support); and Hatch (furnace contract).

Contact Details for Project Information

Horizonte Minerals, tel +44 203 356 2901.

Tavistock, on behalf of Horizonte Minerals, tel +44 207 920 3150 or email horizonte@tavistock.co.uk.