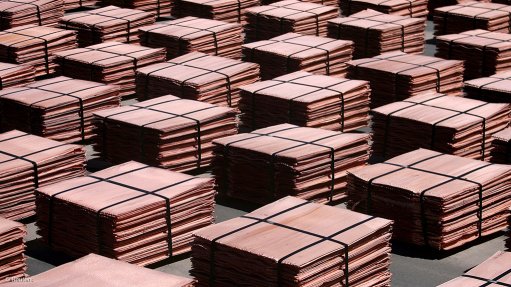

Photo by: Reuters

TORONTO (miningweekly.com) – Chilean copper producer Antofagasta on Tuesday reported that net profit for the six months ended June 30 fell 16.3% year-on-year to $330.8-million as lower revenue and higher costs impacted the bottom line.

The LSE-listed miner reported an 11.5% drop in its core profit, or earnings before interest, tax, depreciation and amortisation to $1.13-billion, reflecting higher production costs and lower copper prices.

Group net cash costs were $1.46/lb, up 15.9% compared with 2013, reflecting lower gold and molybdenum volumes and lower gold prices.

The company reported 4.4% lower copper output for the six months at 348 200 t, mainly owing to lower grades at Los Pelambres and Esperanza.

The group confirmed its full-year output guidance of 700 000 t of copper, 270 000 oz of gold and 7 500 t of molybdenum at net cash costs of $1.45/lb.

“We continue to operate in a challenging market; however, we believe that the market fundamentals for copper are strong. Despite recent increases in new mine supply from various projects coming on-stream, the market remains balanced, contrary to expectations earlier in the year that a supply surplus would emerge,” CEO Diego Hernandez said.